European Commission clarifies its amendments to the EFRAG draft standards

European Commission clarifies its amendments to the EFRAG draft standards

During a public session of the EFRAG Sustainability Board on 14 June 2023, the European Commission (EC) provided some clarifications on its amendments contained in the draft Delegated Act adopting the European Sustainability Reporting Standards (ESRSs) which was opened for comment last Friday.

Some key take-aways:

- Removing the mandatory status on Climate Change and other Disclosure Requirements does NOT make these areas voluntary – rather it enforces the materiality approach on all sustainability topics and keeps the whole package intact.

- Additional phase-in provisions allows companies to start reporting in a compliant manner while they are developing processes to gather the more challenging data.

- The threshold of 750 employees on certain new phase-in provisions is expected to assist approx. 30,000 companies from the estimated total of 50,000 companies that will be in scope of the CSRD.

- EFRAG is working on guidance over the materiality process, which appears to be the most challenging area of the CSRD, but emphasized that the materiality assessment must be a robust process to ensure that all needed information is disclosed and what is not needed is not disclosed.

European Commission adoption of Tax04

In a closely related action, the EC on Monday 13 June 2023 adopted another Delegated Act (known as Tax04) adding additional activities to the EU Taxonomy and proposing new rules for Environmental, Social and Governance (ESG) rating providers, which will increase transparency on the market for sustainable investments – expected to take effect from January 2024. While some commentators believe the simultaneous application of CSRD and Tax04 is too onerous on reporters, the Commission views this package as building on and strengthening the foundations of the EU sustainable finance framework, of which the CSRD is a key component.

At EisnerAmper we make sustainability simply sustainable

Authors

Peter MacDonald

Partner ESG & Advisory

Carmanhall Road

Sandyford

Dublin, D18 CA22

Ireland

ESG Update: European Commission proposes further streamlining of ESG reporting obligations

The European Commission proposes further streamlining of ESG reporting obligations

The European Commission draft act adopting the first set of European Sustainability Reporting Standards (ESRSs) has further streamlined reporting obligations, while not affecting the pursuit of the objective of the Corporate Sustainability Reporting Directive (CSRD). This draft act is open for 4 weeks until 7 July 2023.

This act supplements the Accounting Directive as amended by the CSRD, which requires large companies and listed companies to publish regular reports on the social and environmental risks they face, and on how their activities impact people and the environment.

The modifications to the draft first set of ESRSs are:

Materiality:

All standards and all disclosure requirements and data points within each standard will be subject to materiality assessment by the undertaking, with the exception of the disclosure requirements specified in the “General disclosures” standard. This measure is expected to lead to a significant burden reduction for undertakings and helps to ensure that the standards are proportionate.

Phasing-in for undertakings with less than 750 employees:

– First year: may omit scope 3 GHG emissions data and “own workforce” disclosure requirements; and

– First two years: may omit disclosure requirements for “biodiversity”, “value chain workers”, “affected communities”, and “consumers and end-users”.

Phasing-in for all undertakings:

– First year: may omit disclosure requirements for anticipated financial effects related to non-climate environmental issues (pollution, water, biodiversity, and resource use); and certain datapoints related to their own workforce (social protection, persons with disabilities, work-related ill-health, and work-life balance).

Shift to voluntary for certain disclosures:

Certain disclosures that were mandatory in the draft standards are now voluntary, including: biodiversity transition plans; certain indicators about contract staff in the undertaking’s own workforce; and an explanation of why the undertaking may consider a particular sustainability topic not to be material.

Further flexibilities in certain mandatory disclosures:

These flexibilities cover such areas as: the methodology to use for the materiality assessment process, the disclosure requirements on the financial effects arising from sustainability risks and on engagement with stakeholders. Further flexibilities are included on areas that might be considered to infringe on the right not to self-incriminate.

Coherence with EU legal framework:

Some technical modifications to ensure better alignment with the Accounting Directive and other EU legal instruments.

Interoperability with global standard-setting initiatives:

Further modifications in light of ongoing engagement with the International Sustainability Standards Board and the Global Reporting Initiative.

Editorial and presentational modifications:

To improve the clarity, usability, and coherence of the standards, including for example a drafting convention to clearly identify all terms for which ESRS has a precise definition.

Implementation

The Commission anticipates that the proposed additional phase-in measures and other modifications will reduce the annual costs of compliance by a total of EUR 1,402 million compared to the draft standards proposed by the European Financial Reporting Advisory Group (EFRAG).

The Commission is putting in place an interpretation mechanism to provide formal interpretation of the standards. The Commission has also asked the EFRAG to publish additional guidance and educational material, addressing the materiality assessment process and other issues.

This act shall apply for financial years beginning on or after 1 January 2024 in accordance with the phase-in approach set out in Article 5 of the CSRD, and shall be binding in its entirety and directly applicable in all Member States when it enters into force.

At EisnerAmper we make Sustainability Simply Sustainable.

Authors

Peter MacDonald

Partner ESG & Advisory

Carmanhall Road

Sandyford

Dublin, D18 CA22

Ireland

EisnerAmper Ireland, in conjunction with Insurance Ireland, hosts INED Forum

EisnerAmper Ireland, in conjunction with Insurance Ireland, was delighted to an INED Forum last week. The Forum focused on the Central Bank of Ireland’s Individual Accountability Framework (IAF) and Senior Executive Accountability Regime (SEAR).

Thanks to our panelists Dave Montgomery (Professional Director), Nic Dent (Head of Client Engagement, Worksmart) and Emma Howell (Business Development Manager, Worksmart).

Dave Montgomery provided an insightful overview of IAF and SEAR. Nic Dent and Emma Howell discussed the key learnings from the implementation of the Senior Managers and Certification Regime (SM&CR) in the UK in addition to discussing similarities and differences between SM&CR and SEAR.

We would also like to thank Michael Horan, Manager of Regulation & Policy Development, at Insurance Ireland for setting the scene, and to Brendan McCarthy, INED, for facilitating a thought-provoking Q&A session.

To learn more about SEAR here

Latest News →The EU’s Sustainable Finance Framework and Application for non-EU Fund Companies

An overview of: EU Taxonomy, Corporate Sustainability Reporting Directive (CSRD), and Sustainable Finance Disclosure Regulation (SFDR)

Background

The European Union passed the Green Deal in 2019. The ultimate objective is to transform the EU into a modern, resource-efficient and competitive economy, with the following aims:

- no net emissions of greenhouse gases by 2050 (i.e.: climate-neutrality)

- economic growth decoupled from resource use

- no person and no place left behind

To help achieve the first aim, the EU is aiming for greenhouse gas emissions to be cut by 55% (in comparison to 1990 levels) by 2030.

As part of the Green Deal, the EU has outlined the Sustainable Finance Framework, which is intended to help embed sustainability factors at various levels of the economy.

The three most important elements that comprise the Sustainable Finance Framework are:

- the EU Taxonomy Regulation

- the Corporate Sustainability Reporting Directive (CSRD)

- the Sustainable Finance Disclosure Regulation (SFDR)

The three elements are separate, but closely interlinked. While the EU Taxonomy provides the classification framework for sustainable activities, the CSRD regulates sustainability reporting and the SFDR defines the disclosure requirements for selling financial products.

The EU Taxonomy Regulation

The EU Taxonomy Regulation (“the Taxonomy”) sets criteria to determine whether an economic activity can be considered sustainable.

The Taxonomy provides companies and investors with appropriate definitions of economic activities that can be considered environmentally sustainable. The aim is to create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed.[1]

The Taxonomy establishes six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

It sets out four overarching conditions that an economic activity must meet in order to qualify as environmentally sustainable. According to the Taxonomy, a sustainable economic activity has to be (i) assigned to a defined taxonomy activity, (ii) contribute substantially to one of six environmental objectives above, (iii) not significantly harm any of the remaining environmental objectives, and (iv) comply with a series of minimum social safeguards.[2]

The Taxonomy has applied to certain, large EU companies from 1 January 2021.

The Taxonomy will apply to non-EU companies with a net turnover over €150,000,000 (c. $165 million) in the EU, if they have at least one subsidiary or branch in the EU and exceed certain other thresholds. For such companies, the Taxonomy will apply from January 1, 2028, with reports due in 2029.

The Corporate Sustainability Reporting Directive

The Corporate Sustainability Reporting Directive (“CSRD”) establishes a uniform framework for the reporting of non-financial data for companies operating in the European Union.

The CSRD aims to provide greater transparency and more comparable and standardised information on how companies perform from a sustainability perspective. This information is essential for funds and fund managers seeking to integrate ESG considerations into their investment decisions and to comply with their obligations under the EU Sustainable Finance Framework.[3]

The CSRD will replace the existing Non-Financial Reporting Directive (NFRD), significantly extending the scope of companies required to report and expanding the range of reporting requirements. Companies will have to cover key ESG areas such as the environment, human rights, social responsibility, and diversity in their reports.

A key concept introduced by the CSRD is double materiality. Double materiality means that companies must consider and report on not only the impact of environmental changes on their business, but also on the impact of their operations on the environment (including social and governance issues).

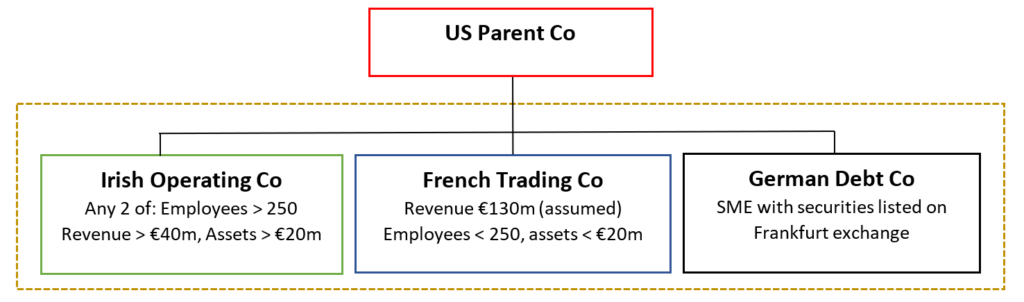

The CSRD is applicable to non-EU parent companies which either:

- have securities listed on an EU regulated market and have more than 500 employees, or

- have a qualifying EU branch or subsidiary (see below) and generate net turnover of more than €150 million in the EU over two consecutive years.

A qualifying EU branch is one having net turnover of more than €40 million.

A qualifying EU subsidiary is a large company being one that exceeds any two of:

i. 250 employees;

ii. €40 million net turnover; or

iii. €20 million total assets;

or a small or medium-sized entity (SME) with securities listed on an EU regulated market.

The CSRD will begin to impact the 2024 reporting period for in-scope, EU companies.

For non-EU parent companies, CSRD consolidated sustainability reporting requirements on their EU operations will be required from their 2028 financial year. However, if the non-EU Parent company has securities listed on an EU regulated market and has more than 500 employees, its individual and consolidated reporting obligations will start from its 2024 financial year.

Sustainable Finance Disclosure Regulation

The Sustainable Finance Disclosure Regulation (“SFDR”) is a set of rules which require financial market participants (i.e.: fund managers) to provide information about how they deal with negative environmental and social impacts and risks of their investments.[4]

The disclosure requirements of the SFDR are intended to illustrate to investors and the public the extent to which companies or products meet sustainability benchmarks. Fund managers must disclose how sustainability risks are considered in their investment process, what metrics they use to assess ESG factors, and how they consider investment decisions that might result in negative effects on sustainability factors.

The SFDR requires disclosures at the company level as well as at the product level.

In addition, financial companies must disclose their Principal Adverse Impacts (PAIs) on Sustainability. PAIs consist of mandatory, core indicators and additional opt-in indicators from the areas of greenhouse gas emissions, energy efficiency, biodiversity, water, waste, social and employee affairs, human rights and corruption. The information on PAIs must be published on in-scope companies’ websites.

At the product level, the SFDR distinguishes three categories of financial products, with different levels of disclosure requirements depending on classification:

- General financial products (“Article 6 funds”)

- ESG financial products with environmental or social characteristics (“Article 8” or “light green funds”)

- ESG financial products with the aim of sustainable investment (“Article 9” or “dark green funds”)

Mandatory disclosure of sustainability data under SFDR has been in place since 10 March 2021.

Non-EU fund managers will be in scope to the extent that they register any of their funds for marketing under national private placement rules in any EU member state. They are also potentially in scope to the extent that they manage or advise EU-domiciled funds, even if those funds are not privately placed in the EU.

The three regulatory requirements above are interlinked with some overlap in terms of content. The Taxonomy defines what is considered sustainable under any financial product level information disclosed by investee companies under the CSRD. The reporting provided by the CSRD will be used by fund managers to satisfy the Principal Adverse Impacts (PAI) disclosures under SFDR.

At EisnerAmper we make sustainability simply sustainable.

Authors

Peter MacDonald

Partner ESG & Advisory

Carmanhall Road

Sandyford

Dublin, D18 CA22

Ireland

EisnerAmper Ireland visit the LauraLynn Children’s Hospice

Members of EisnerAmper Ireland’s Service Excellence Team (SET) were delighted to visit LauraLynn, Ireland’s only children’s hospice, last Thursday afternoon to lend a helping hand. During their visit, the team assisted in maintaining the facilities for the children and their families through gardening and painting. This experience also provided an opportunity for our team to see first-hand the incredible work the staff at LauraLynn do on a daily basis and further solidified our commitment to supporting this amazing organization.

LauraLynn Children’s Hospice is a remarkable organisation, dedicated to providing specialist palliative and supportive care services to children with life- limiting conditions. As Ireland’s only children’s hospice, LauraLynn’s mission is to provide a Community of Care that delivers evidence-based, personalised services to children with palliative care needs, complex care needs and complex disabilities, while also providing family support services and a home to their residents where quality-of-life is paramount.

Learn how you can help here

Latest News →

Celebrating Diversity Month at EisnerAmper Ireland

At EisnerAmper Ireland, we are celebrating Diversity Month. As part of our celebrations, we hosted a fantastic all-staff lunch yesterday to recognise and embrace the unique cultures, backgrounds and traditions of our team. The lunch was a big success and it was great see so many members of our team come together to celebrate and to learn from each other.

Over the course of the month, our colleagues also recorded videos and created posters which have been on display in our office. These videos and posters have been a wonderful way to showcase the diverse cultures and perspectives that exist within our team and help to foster a greater understanding and appreciation of these cultures and perspectives.

At EisnerAmper Ireland, we’re committed to creating a workplace where everyone feels welcome.

Staff Lunch

Zimbabwe – Keith Magweba, Semi Senior, Audit

Brazil – Laura Lima, Trainee Chartered Accountant, Audit

India – Vanshika Bharani, Trainee Chartered Accountant, Audit

Moldova – Carolina Tolici, Trainee Chartered Accountant, Audit

Sri Lanka – Pamoda Senadheera , Manager, Audit

Latest News →

Where to start with ESG Reporting?

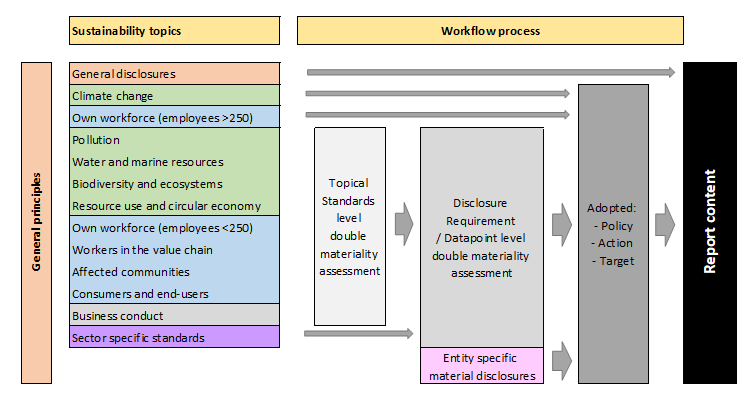

Complying with the new EU Corporate Sustainability Reporting Directive (CSRD) and the disclosure requirements set out in the (draft) European Sustainability Reporting Standards (ESRS) might seem overwhelming, particularly for businesses that have not previously prepared sustainability reports. In this article, we describe a workflow approach that will assist businesses in meeting their compliance obligations, and help shape their transition towards a more sustainable and circular business model, delivering benefits for their business and other stakeholders.

As a reminder, the CSRD Sustainability Reporting requirements come into effect as follows:

FY 2024 -> Listed companies and other Public Interest Entities with more than 500 employees (currently in scope of the EU Non-Financial Reporting Directive (NFRD) and the Taxonomy Directive)

FY 2025 -> All other ‘large’ companies, i.e. those that exceed any two of the following:

– Net turnover of €40m

– Total assets of €20m

– Average employees of 250

FY 2026*-> Listed SMEs (that are not micro-enterprises), small and non-complex credit institutions and captive insurance undertakings (*with an option to defer until FY 2028)

FY 2028 -> Third country undertakings with significant operations in the EU

(see our previous post on third country undertakings here)

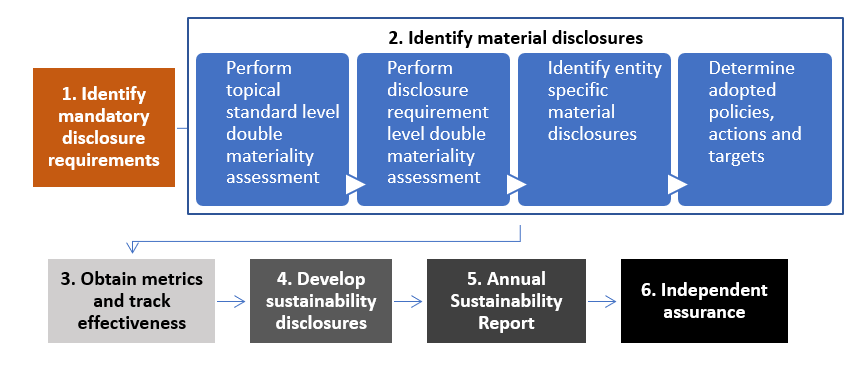

A Sustainability Reporting Workflow

The content of the directive and related standards suggest a logical workflow: starting with the mandatory requirements and working through materiality assessments to develop relevant sustainability disclosures. The steps in a Sustainability Reporting Workflow are summarised in the below diagram and are then addressed under relevant headings.

Sustainability Reporting Workflow

- Identify mandatory disclosure requirements

Undertakings must disclose all material information regarding impacts, risks and opportunities in relation to environmental, social and governance matters. What constitutes material information is determined after performing a double materiality assessment, described below. Regardless of the outcome of the materiality assessment, the standards establish certain information to be mandatorily provided by the undertaking:

- ESRS 2 – General disclosures

- EU Law datapoints

- ESRS E1 – Climate change

- ESRS S1 – Own workforce, if more than 250 employees

ESRS 2 – General disclosures covers Disclosure Requirements relating to sustainability governance, strategy and business models, the materiality assessment process, and for policies, actions, targets and metrics regarding identified material topics. Undertakings will need to assess their compliance against these requirements and develop a plan to address any shortcomings / gaps.

EU Law datapoints are embedded in the relevant topical standards, and are tabulated in ESRS 2 Appendix C. They are to be reported irrespective of the outcome of the materiality assessment. Undertakings should, by virtue of addressing the relevant existing legal obligations, already be well positioned to respond to these disclosure requirements and will benefit from the reporting framework and guidance provided by these standards.

ESRS E1 – Climate change covers Disclosure Requirements regarding climate-related hazards that can lead to physical climate risks for the undertaking and its adaptation solutions to reduce these risks. It also covers transition risks arising from the identified adaptation solutions to climate related hazards. These Disclosure Requirements are categorised under: “Climate change mitigation”, “Climate change adaptation” and “Energy”.

Climate change mitigation relates to the undertaking’s endeavours towards holding the increase in the global average temperature to well below 2 °C and pursuing efforts to limit it to 1.5 °C above pre-industrial levels, as laid down in the Paris Agreement.

Climate change adaptation relates to the undertaking’s process of adjustment to actual and expected climate change.

Energy covers requirements related to all types of energy production and consumption.

ESRS S1 – Own workforce itemises certain Disclosure Requirements that are mandatory for undertakings with more than 250 employees. These disclosures include an explanation of the general approach the undertaking takes to identify and manage any material actual and potential impacts on its own workforce in relation to a comprehensive listing of social, including human rights, factors.

Own workforce is understood to include both workers who are in an employment relationship with the undertaking (“employees”) and non-employee workers who are either individuals with contracts with the undertaking to supply labour (“self-employed workers”) or workers provided by undertakings primarily engaged in “employment activities” (NACE Code N.78). Workers in the undertaking’s upstream or downstream value chain are covered in another (not mandatory) standard.

- Identify material disclosures

An enterprise conducts a materiality assessment to identify disclosure requirements arising from material impacts, risks and opportunities in the following phases:

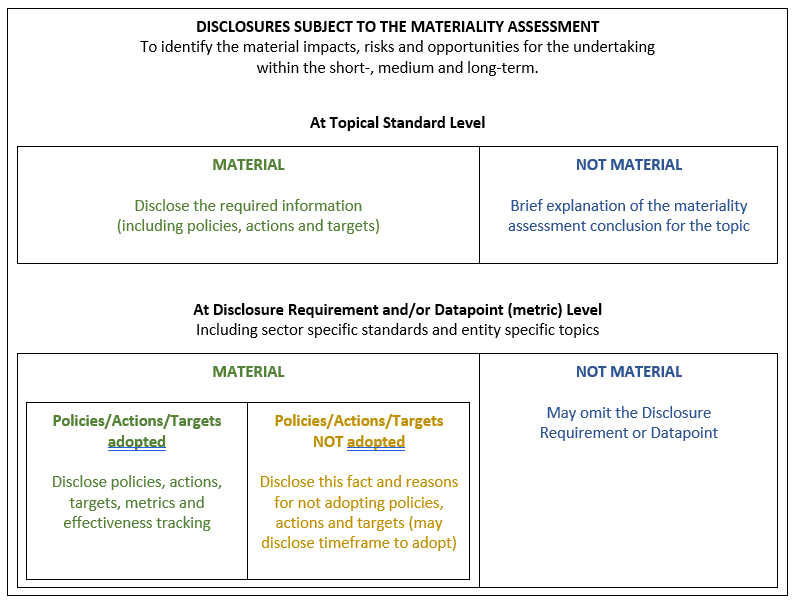

Topical standard level – When a topical standard is assessed not to be material for the undertaking, the undertaking may omit all the Disclosure Requirements in the topical standard. The undertaking shall report a brief explanation of the conclusions of its materiality assessment for the topic. For example, where an in-scope special purpose entity has no employees, it may reasonably conclude that ESRS S1 – Own workforce is not material and therefore omitted entirely, with an appropriate explanation.

Disclosure Requirement level – When a topical standard is assessed to be material for the undertaking, the undertaking shall assess the materiality of all Disclosure Requirements of the relevant standard. When a specific Disclosure Requirement is assessed as not material for the undertaking, the undertaking may omit the specific Disclosure Requirement. For example, where a company does not have non-employee workers (e.g. self-employed contractors), it may reasonably conclude that DR S1-7 – Characteristics of non-employee workers in the undertaking’s own workforce is not material and therefore omitted from the ESRS S1 – Own workforce disclosures.

Entity specific disclosures – When the undertaking concludes that an impact, risk or opportunity not covered or covered with insufficient granularity by a standard is material due to its specific facts and circumstances, it shall provide additional entity-specific disclosures to cover such impact, risk or opportunity. Where the undertaking develops such material entity-specific disclosures it shall report those disclosures alongside the most relevant sector-agnostic and sector-specific disclosures.

Policies, Actions and Targets – If the undertaking cannot provide relevant disclosures on a material sustainability matter because it has not adopted policies and/or actions and/or targets with reference to the specific material sustainability matter concerned, it shall disclose this to be the case, and provide reasons for not having adopted policies and/or actions and/or targets. The undertaking may report a timeframe in which it aims to adopt them.

The table below illustrates the impact of the materiality assessment on sustainability disclosures.

Disclosures subject to the materiality assessment

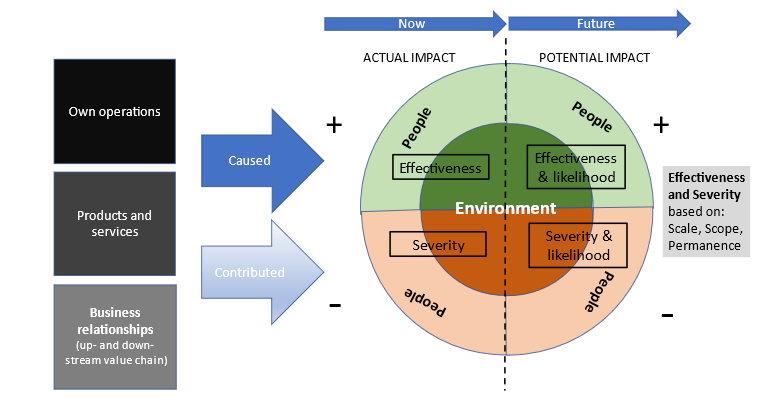

Applying the double materiality assessment

Performing a materiality assessment is necessary for the undertaking to identify the material impacts, risks and opportunities to be reported. A sustainability matter is material when it meets the criteria defined for impact materiality or for financial materiality. Although impact materiality and financial materiality are inter-related, in general the starting point is the assessment of impacts. A sustainability impact may be financially material from inception or become financially material over time. Material impacts are included irrespective of their financial materiality assessment.

The undertaking determines appropriate thresholds to determine which identified impacts, risks and opportunities are material sustainability matters for reporting purposes.

Impact materiality – An undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- and long-term time horizons are its material impacts. Impacts include those caused or contributed to by the undertaking and those which are directly linked to the undertaking’s own operations, products, or services, or through its business relationships. Business relationships include the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.

Materiality of negative impacts considers the severity of actual negative impacts and the likelihood and severity of potential negative impacts. Materiality of positive impacts considers the effectiveness of actual impacts and the likelihood and effectiveness of potential positive impacts. Severity and effectiveness are assessed based on the scale (how grave or beneficial the impact is), the scope (how widespread the impact is), and permanence (how remediable the negative impact is, or how transient the positive impact is).

The undertaking’s actions to address certain impacts or risks, or to benefit from certain opportunities in relation to an identified material sustainability matter, might itself have material negative impacts or cause material risks in relation to other sustainability matters. For example, action plans to decarbonise own operations by abandoning a plant may have material negative impacts on their own workforce, workers in the value chain or affected communities. In such circumstances, undertakings shall disclose these material negative impacts or risks with a cross-reference to the affected sustainability topic disclosures.

Impact materiality assessment

Engagement with affected stakeholders is central to the undertaking’s ongoing due diligence process to identify actual or potential negative impacts, and to assess and identify material impacts for the purpose of sustainability reporting. Affected stakeholders are individuals or groups whose interests are affected or could be affected – positively or negatively – by the undertaking’s activities and its direct and indirect business relationships across its value chain. Common categories of stakeholders are: employees and other workers, suppliers, consumers, customers, end users, local communities and vulnerable groups, and authorities (including regulators, supervisors and central banks). Nature may be considered a silent stakeholder.

Financial materiality – The scope of financial materiality for sustainability reporting is an expansion of the scope of materiality used in the process of determining which information should be included in the undertaking’s financial statements. A sustainability matter is material from a financial perspective if it triggers or may trigger material financial effects on the undertaking, including: cash flows, development, performance, position, cost of capital or access to finance in the short-, medium- and long-term time horizons.

Risks and opportunities may derive from past or future events and may impact:

- assets and liabilities already recognised in financial reporting or that may be recognised as a result of future events; or

- other factors of value creation not recognised in financial reporting but having a significant influence on financial performance, such as natural, intellectual (organisational), human, social and relationship capitals.

The financial materiality of a sustainability matter is not constrained to matters that are within the control of the undertaking but includes information on material risks and opportunities attributable to business relationships with other undertakings/stakeholders beyond the scope of consolidation used in the preparation of financial statements.

The materiality of risks and opportunities is assessed based on a combination of the likelihood of occurrence and the size of the potential financial effects.

- Obtaining metrics and tracking effectiveness

The Disclosure Requirements contained in the standards prescribe disclosure content regarding Policies, Targets, Actions, and Metrics related to a specific sustainability matter:

Policies – refer to general objectives or management decisions implementing the undertaking’s strategy towards a material sustainability matter.

Targets – refer to measurable, outcome-oriented goals that the undertaking aims to achieve.

Actions – including action plans and transition plans, are implemented to ensure that the undertaking delivers against the policies and targets.

Metrics – are qualitative and quantitative indicators that the undertaking uses to measure and report on effectiveness of delivery against policies, targets and actions over time.

For most Disclosure Requirement sets, the standard prescribes the relevant metrics. For example, ESRS E1 Climate Change DR E1-5 Energy consumption and mix requires disclosure of total energy consumption in MWh related to own operations across 6 categories of non-renewable sources and 3 categories of renewable sources, and where applicable, the disaggregated renewable and non-renewable energy production. In some cases, identifying and obtaining the relevant datapoints will involve reference to sector-specific or cross-sector methodologies, such as the Science-based Target Initiative.

For each metric the undertaking shall describe how the metric is used to track effectiveness, shall use clear and precise names and descriptions, and disclose whether the metric is externally validated. Information presented should be disaggregated for a proper understanding of the material sustainability matter, by country or region, by sector, or by site or significant asset.

Past, present and future is linked by presenting one year of comparative information for all metrics disclosed in the current year, and reporting against a base year, and where relevant presenting forward-looking information, for an understanding of progress towards targets.

The use of reasonable assumptions and estimates, including scenario or sensitivity analysis, is an essential part of preparing sustainability-related metrics and does not undermine the usefulness of the information, provided that the assumptions and estimates are accurately described and explained. Even a high level of measurement uncertainty would not necessarily prevent such an assumption or estimate from providing useful information or meeting the qualitative characteristics of information.

- Develop sustainability disclosures

The (draft) ESRS 1 – General requirements standard provides guidance on the content and structure of the sustainability statements, including a non-binding example structure. The standard expects all required sustainability disclosures to be in a single section of the company’s management report, which accompanies its annual financial statements. Information already provided in another part of the sustainability report or elsewhere in the company’s financial statements, management report, corporate governance report or remuneration report, may be included by reference to avoid duplication.

Relationships between information in the sustainability statements and other information in the annual report must be described clearly and concisely, to illustrate consistency of data and assumptions. Sustainability disclosures and datapoints must be linked with specific references to relevant paragraphs and include reconciliations for financial or other quantitative data.

For example, sustainability targets for reducing use of natural resources may need to be linked to the strategic response to limit impact through related investments in new assets or divesting of existing assets. This information may also need to be reconciled with financial statement metrics on production costs and related financial performance targets.

The Sustainability Reporting Workflow and Double Materiality assessment process is illustrated in the below diagram:

Developing disclosures for material sustainability matters

- Annual Sustainability Report

Drawing up and publishing information in compliance with the sustainability reporting standards is the collective responsibility of the members of the administrative, management and supervisory bodies of an undertaking, as an extension of their responsibilities for financial statements and other management reports.

The standards require an undertaking to disclose how the administrative, management and supervisory bodies are informed about sustainability matters and how these matters were addressed during the reporting period. An undertaking shall also disclose information about the integration of its sustainability-related performance in incentive schemes and how the interests and views of its stakeholders are taken into account.

- Independent Assurance

The sustainability report shall be accompanied by an assurance opinion expressed by a person or firm authorised to give an opinion as regards the compliance of the sustainability reporting with the requirements of the CSRD, including the compliance of the sustainability reporting with the sustainability reporting standards to be adopted (the ESRSs). (See our previous post on the assurance requirements here.)

Start here, start now!

Preparing for your first Annual Sustainability Report for FY 2024 (listed and other public interest entities) or FY 2025 (other ‘large’ companies) will require careful and thorough planning. Following a governance-based structured sustainability reporting workflow will ensure that your sustainability report is:

- compliant with the relevant EU regulations and related reporting standards;

- supported by documented processes, decisions and evidence; and

- ready for independent assurance.

At EisnerAmper we make sustainability simply sustainable.

Authors

The content above is provided for general information purposes only and is not intended to provide, nor does it constitute, professional advice on any particular matter. If you would like more information or would like to discuss any of the topics raised above, please contact the author(s).

The content above is provided for general information purposes only and is not intended to provide, nor does it constitute, professional advice on any particular matter. If you would like more information or would like to discuss any of the topics raised above, please contact the author(s).