Irish company law requires directors of companies incorporated in Ireland to prepare entity financial statements in respect of each financial year. Such financial statements must be prepared either in accordance with:

Or as

FRS 102, (”FRS102 The Financial Reporting Standard applicable in the UK and Republic of Ireland’) is the principal accounting standard in the Companies Act financial reporting regime. It is largely based on IFRS for SMEs but with significant adaptations for UK & Ireland.

It is subject to periodic review by the FRC. The most recent review in 2024 introduced significant changes which are mandatory for accounting periods beginning on or after 1 January 2026.

The periodic review 2024 introduces significant amendments to the following sections:

In addition, incremental improvements and clarifications have been made throughout the text of FRS 102 to align the standard with the latest international accounting standards (i.e. IFRS) in certain respects, and to include new and additional guidance to make the requirements easier to understand and apply consistently.

The September 2024 edition of FRS 102 will be mandatory for accounting periods beginning on or after 1 January 2026.

The amendments to Section 20 Leases are based on the principles of IFRS 16 Leases and consequently, for lessees, the distinction between operating and finance leases is removed. This means that the majority of leases will be recognised on-balance sheet.

While lessor accounting remains largely unchanged, the amendments have a significant impact on the recognition, measurement, presentation and disclosure requirements of leases for lessees.

In summary, lessees will be required to:

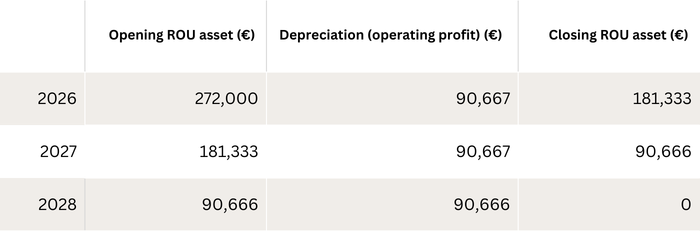

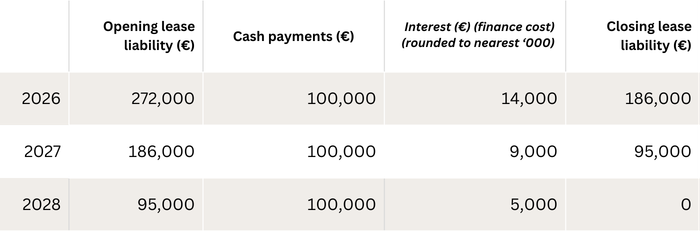

Lease term: 3 years

Annual payment payable in arrears: €100,000

Discount rate: 5%

Section 23 Revenue from Contracts with Customers of FRS 102 was completely rewritten as part of the periodic review 2024 to be based on the principles in IFRS 15 Revenue from Contracts with Customers.

The updated Section 23 replaces the previous risks-and-rewards-based revenue model with a single, principles-based framework focused on the transfer of goods or services to customers, aligning more closely with IFRS 15.

To apply the model, an entity shall take the following steps:

Step 1 – Identify the contract(s) with a customer;

Step 2 – Identify the performance obligations in the contract;

Step 3 – Determine the transaction price;

Step 4 – Allocate the transaction price to the performance obligations in the contract; and

Step 5 – Recognise revenue when (or as) the entity satisfies a performance obligation.

Many contracts will have a single performance obligation. However, when a contract has more than one performance obligation the subsequent steps of the revenue recognition model are designed to ensure that the revenue associated with each performance obligation is recognised at the appropriate time.

There are more disclosure requirements in the new Section 23 which are intended to provide more useful information to users of financial statements about the nature, amount and timing of revenue and cashflows arising from an entity’s contracts with customers.

Entities will need to reassess the accounting treatment of revenue contracts. The application of Section 23 will affect contracts with bundled goods and services, variable consideration, warranties, customer options, financing components and principal vs agent arrangements, as well as obligations satisfied over time.

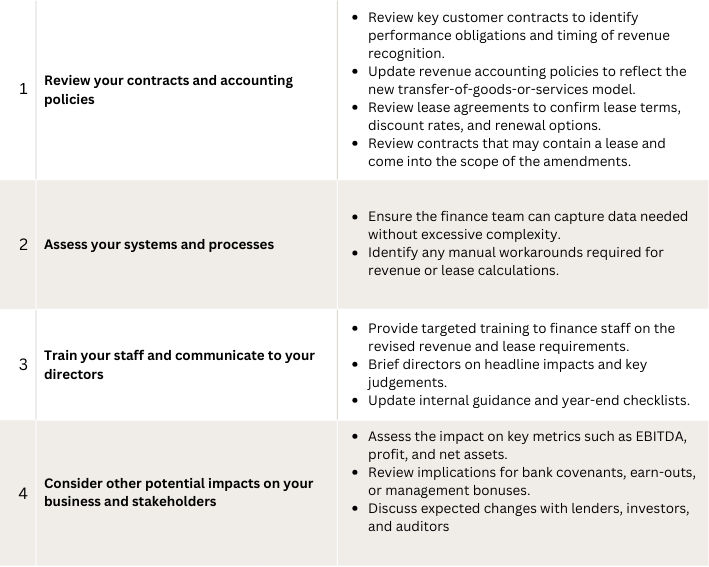

To prepare for the amendments, Finance teams should assess how the revised requirements, particularly on revenue recognition and leases, affect existing contracts, accounting policies, systems, and KPIs.

If you would like to have an initial conversation about FRS 102 changes and the potential impacts on your business or if you need specific advice or assistance in respect of the above requirements, feel free to reach out directly. My contact details are as follows: Gavin Redmond on +353 1 2933471 or gavin.redmond@eisneramper.ie

+353 1 293 3400

+353 1 293 3400

+1 212 949 8700

+1 212 949 8700

+1 345 945 5889

+1 345 945 5889

+65 6305 9900

+65 6305 9900