EisnerAmper Ireland takes part in Run in the Dark 2019

On 13 November 2019, EisnerAmper Ireland joined thousands of runners to partake in Run in the Dark for the third consecutive year, to support ongoing research to find a cure for paralysis.

Team EisnerAmper joined all of the other participants at the Custom House Quay to begin their race at 8.00pm.

Run in the Dark is the main fundraiser for the Mark Pollock Trust, which believes we can cure paralysis in our lifetime. Unbroken by blindness in 1998, adventure athlete Mark Pollock was left paralysed in 2010. Now, with the team at the Mark Pollock Trust, he is exploring the intersection where humans and technology collide, catalysing collaborations that have never been done before and unlocking $ 1 billion to cure paralysis in our lifetime.

Some of our EAI runners. (L to R Warren Bridge, Matthew McCarthy, Sarah Ryan and Thomas Territt)

EIsnerAmper’s Jonathon Squire with Mark Pollock.

(L to R: Matthew McCarthy & Thomas Territt).

At EisnerAmper Ireland, we design solutions to support our community.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →

EisnerAmper’s Frank Keane receives Honorary Fellow Award from IADT

On Friday 8 November, Frank Keane, Partner and Head of Client Internationalisation at EisnerAmper Ireland, received the Honorary Fellow Award by the Institute of Art, Design and Technology, (IADT) in the RDS Dublin at their conferring ceremony.

An Honorary Fellow Award is a mark of high distinction that the Institute can award to persons in recognition of their distinguished achievements, or close association with IADT.

Having studied Business and Law in UCD and completing a masters in Accounting, Frank went on to become a Chartered Accountant. Following this, Frank began lecturing in IADT and he is now leading the provision of EisnerAmper’s Training & Consulting services. Frank leads a team which consults upon, designs and delivers bespoke professional training programs to public and private sector organisations and internally to our own professional staff.

Frank received this award in recognition of his contribution to Irish business regionally, nationally and internationally and for his outstanding support for IADT students, staff and graduates over the last 20 years.

We care about business and we care about the people we work with in business.

EisnerAmper Ireland has a world-class focus on personal growth and development. We recognise that our people and our skills are key to EisnerAmper Ireland achieving our vision of being recognised as Ireland’s leading professional services firm and our approach to education and training reflects this.

Learn more about our approach to personal and professional development and get current EisnerAmper Ireland job opportunities, here.

Contact Frank

Latest News →EisnerAmper attends Look The Business 2019

On Thursday 7 November, Jennifer Kelly, Partner at EisnerAmper Ireland, attended, Look the Business 2019, the Gloss Magazine’s event in the RDS Dublin as a guest of Stelfox.

The high-profile event focuses on bringing successful women in business together while discussing current issues, successes and the future of fashion in Ireland. Guests enjoyed a champagne reception, a fashion show showcasing international and Irish designers, dinner and light entertainment.

Guest speaker Gina Miller, co-founder of SCM Direct and founder of Centrum Campaign Limited discussed her life, career path and campaigning. A second key note speaker was Trinny Woodall, CEO & founder of Trinny London, presenter, author, fashion and makeup expert who discussed how she made her vision of business come to life and her understanding of women and their attitudes to how they dress while working.

We were delighted to have the opportunity for Jennifer to connect with friends and clients of our firm at such an informative and enjoyable event.

Gina Miller

How EisnerAmper Ireland Can Help

EisnerAmper Ireland’s multi-disciplinary Financial Services team has a broad range of skill-sets and experience with backgrounds in the areas of banking, industry and accounting. Through our team’s understanding and experience of the financial services sector we provide audit, tax, risk & regulatory, outsourcing and advisory services to clients doing business, raising capital and investing in Ireland and Europe.

Contact Us

Latest News →EisnerAmper Ireland attends LK Shields Financial Services Forum

On Thursday 7 November, Ray Kelly, Dave Montgomery and Tom Brennan, Partners at EisnerAmper Ireland, attended the first in the series of LK Shields Financial Services Forums, in the Shelbourne Hotel Dublin.

The event provided some thought-provoking insights from Eibhlin Johnston on transformational leadership, with an interesting panel discussion covering topics such as AML, Beneficial Ownership, Fitness and Probity, CP86 and ILP Legislation. We were delighted to have the opportunity for members of our team to connect with industry colleagues.

How EisnerAmper Ireland Can Help

EisnerAmper Ireland’s multi-disciplinary Financial Services team has a broad range of skill-sets and experience with backgrounds in the areas of banking, industry and accounting. Through our team’s understanding and experience of the financial services sector we provide audit, tax, risk & regulatory, outsourcing and advisory services to clients doing business, raising capital and investing in Ireland and Europe.

Contact Us

Latest News →EisnerAmper Ireland hosts The Academy 2019

The EisnerAmper Ireland Academy, the Firm’s annual all-staff two-day off-site training programme, was held for the eighth year running in The Haddington House Hotel, Dun Laoghaire and The Beacon, Sandyford, on 24 and 25 October 2019.

The programme is specifically designed for our professionals to accelerate their “on the job” learning and to facilitate EisnerAmper Ireland staff on the journey towards becoming not just great accountants but exceptional advisers and practitioners. Participants acquire the necessary core awareness, knowledge, skills and confidence to successfully further their careers in practice.

Pictured: Enda McDonnell presenting for the EAI staff

The theme of this year’s programme was ‘EAI 2.0 – The Professional Services and Solutions Firm’ and included workshops, technical training, team building and knowledge exercises reaffirming EisnerAmper Ireland’s commitment to achieving and maintaining excellence in everything we do. The workshops encouraged our staff to develop their design thinking skills and their self-awareness.

Guest speakers included Enda McDonnell, Manager at Enterprise Ireland and Ian Kiely, CEO of Drone Consultants Ireland who discussed their journey in the new technological age of business. Peter Cogan, Partner, EisnerAmper U.S, facilitated an afternoon workshop and discussed the Eisneramper U.S’ growth and technological developments. Peter opened the group to a Q & A of how EisnerAmper U.S works differently to our Firm.

Participants also enjoyed some downtime where they could avail of a three-course meal in the Haddington House restaurant.

Ian Kiley presenting for the EAI staff

From L to R: Alastair MacDonald, Peter Cogan and Paul MacCarthy

We care about business and we care about the people we work with in business.

Our trainees are involved in all elements of practice management from day one. From the outset, trainees work closely with partners and senior management to deliver services to our key markets. This approach facilitates our trainees getting hands-on experience while also developing the core awareness, knowledge, skills and confidence to succeed in their careers. To learn more about our trainee programme, click here.

Latest News →EisnerAmper participates in Great Pink Run 2019

EisnerAmper Ireland is proud to have been a participant in the 2019 Great Pink Run which took place on Saturday 19 October in the Phoenix Park. The event was hosted in aid of Breast Cancer Ireland in association with Avonmore Slimline milk and catered for walkers, joggers and fun runners who could complete a 5k fun run or a 10k challenge.

The race, in aid of Breast Cancer Ireland, is a great way to help ‘run for a cure’. With 1 in 9 women developing breast cancer in their lifetime, everybody knows someone that has been affected, making it all the more important to continue investing in research through fundraisers like this to help transform breast cancer from often being a fatal disease to a long term treatable illness.

To learn more about the Great Pink Run, click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper hosts Pupcake Bake Sale in aid of Dogs Trust

On Friday, 11 October 2019, EisnerAmper Ireland hosted a Pupcake Bake Sale in aid of Dogs Trust. We were delighted to support such an excellent charity while enjoying some delicious cakes made and bought by our staff.

Pupcake Day aims to help Dogs Trust change the lives of abandoned and neglected dogs from all over Ireland – from rescue, through to the day they find their Forever Homes. Dogs Trust have hundreds of puppies and dogs looking for their special someone.

All puppies and dogs in their rehoming centre are neutered, microchipped, fully vaccinated and the charity offer a lifetime of training and behavioural support for all dogs and puppies rehomed from their centre. Last year, the charity rescued 2,025 dogs, therefore every pupcake bake sale helps in continuing the work of Dogs Trust Ireland.

To learn more about Dogs Trust and to find out how you can help, click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →Budget 2020

With Budget 2020 announced earlier this week, EisnerAmper Ireland examines its effect on Irish-based businesses across the following four areas:

- Corporation Tax;

- Indirect Tax;

- Employment and Personal Tax; and

- Other Taxes.

1. Corporation Tax

– Corporation tax rate on trading profits

There has been no change to the 12.5% corporation tax rate applicable to the trading profits of a company.

– Research and Development (R&D) Credit

The R&D credit is being revised for small and micro companies to increase the R&D credit from 25% to 30% and to improve the current method of calculating the limit(s) on the payable credit. New legislation is also being introduced to allow small companies carrying out pre-trading R&D to avail of the credit before trading starts – however the R&D offset in these circumstances is confined to VAT and payroll tax liabilities only. The new rules for small and micro companies are both subject to State aid approval.

With regard to all R&D claimants, the existing limit on outsourcing to third level institutes of education will be increased from 5% to 15%.

– Anti-hybrid measures

Finance Bill 2019 will introduce new anti-hybrid rules which will apply to all corporate tax payers from 1 January 2020. The introduction of these new anti-hybrid rules forms part of Ireland’s promise to implement the Anti-Tax Avoidance Directive (ATAD) and the new rules will be ATAD compliant. The rationale behind the introduction of the anti-hybrid rules is to preclude arrangements that abuse variances in the tax treatment applied under the laws of multiple jurisdictions to generate a tax benefit.

– Transfer Pricing (TP)

The Minister confirmed that updated TP legislation will be included in Finance Bill 2019. These updates will include the formal adoption of the OECD’s 2017 TP Guidelines into Irish domestic legislation and also the extension of transfer pricing rules to cover material capital transactions and cross-border non trading transactions. Subject to Ministerial Commencement Order, the new measures to be introduced will also expand the application of transfer pricing rules to SME’s.

2. Indirect Tax

– VAT

The only change to VAT was the reduction in the qualifying CO2 threshold for reclaims on commercial vehicles.

– Other Indirect Tax considerations

The rate of carbon tax on fuel has increased from €20 to €26 per tonne of CO2. This has been applied to diesel and petrol as of midnight on 8 October 2019, with the increase to home heating oil being deferred until May 2020.

A Nitrous Oxide tax will replace the 1% VRT surcharge on new diesel engine passenger vehicles registered from 1 January 2020.

VRT reliefs for conventional and plug-in hybrid vehicles has been extended until the end of 2020.

3. Employment and Personal Tax

– Income Tax, USC and PRSI

The Home Carer tax credit has increased by €100 to €1,600 and the Earned Income tax credit has increased by €150 to €1,500 for 2020. There was no other change to rate bands and credits.

The reduced rate of USC for medical card holders and people aged 70 and above whose income is €60,000 or less has been extended until 31 December 2020.

The rate of Employer’s PRSI will increase from 10.95% to 11.05% in 2020. Employee’s PRSI is unchanged.

– Benefit in Kind (BIK)

The 0% BIK rate for employers providing electric cars or vans has been extended to 31 December 2022.

– Special Assignee Relief Programme (SARP)

The SARP scheme has been extended until 31 December 2022.

– Key Employee Engagement Programme (KEEP)

Further amendments were announced to the KEEP scheme which was introduced in 2018. Under the new measures the scheme will also apply to:

- Group corporate structures;

- Part time employees; and

- Existing shares.

4. Other Taxes

– Capital Acquisitions Tax (CAT)

The tax-free Group A threshold for gifts or inheritances from a parent to child has increased by €15,000 to €335,000.

– Stamp Duty (SD)

The rate of SD with regard to non-residential property has increased by 1.5% to 7.5% with effect from 9 October 2019. However, the old 6% rate will apply to instruments executed on or before 31 December 2019, where a binding contract was entered into prior to 9 October 2019 and is accompanied by a statement certifying this.

– Dividend Withholding Tax (DWT)

The rate of DWT will increase by 5% to 25% with effect from 1 January 2020.

How EisnerAmper Ireland Can Help

At EisnerAmper Ireland, we design and deliver business & compliance solutions to make trade happen. This is what we do every day.

EisnerAmper Ireland’s Tax Department provides support to the Firm’s Financial Services and International Business market groups. We advise corporates, their people and principals operating in the technology, life sciences, real estate, structured finance, aircraft leasing and investment funds industries. To find out more, visit our Tax Services page

Tax Services

Request a Callback from our Tax specialists now.

Authors

The content above is provided for general information purposes only and is not intended to provide, nor does it constitute, professional advice on any particular matter. If you would like more information or would like to discuss any of the topics raised above, please contact the author(s).

EisnerAmper hosts Big Brunch in aid of the Irish Hospice Foundation

EisnerAmper was delighted to support Ireland in their match against Russia in the Japan Rugby World Cup this morning in the EAI office in aid of the Irish Hospice Foundation.

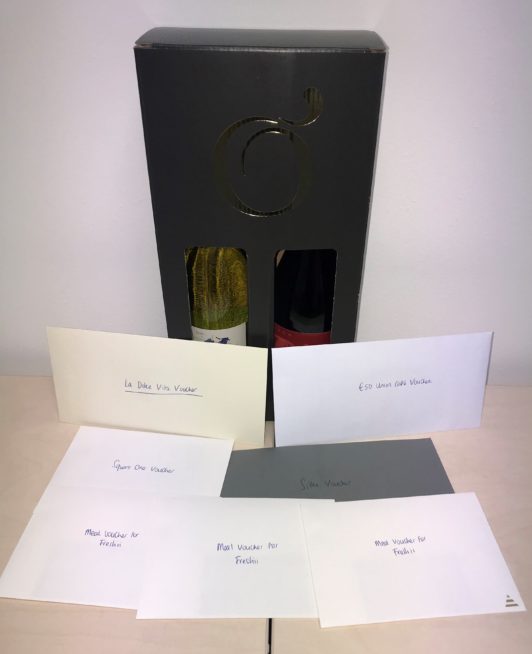

Staff enjoyed brunch during the match catered by The Food Crew Sandyford. At the end of the game a raffle was held and prizes included very kind donations from the local business community including, Union Café, La Dolce Vita, Sqaure One, Freshii, Silke Hair and Beauty and O’Briens Wines. We are proud to donate over €800 from the match viewing and raffle to the Irish Hospice Foundation.

The Irish Hospice Foundation strives for the best care at end of life for people and practical support for their loved ones. The foundation provides nurses for night care, hospice home care for children and palliative care for all, including many other facilities. The Irish Hospice Foundation is the only national organisation dedicated to dying, death and bereavement in Ireland. With state funding being less than 8% of their total income in 2017, the hospice relies on the public to fund the majority of their work. To read more about the foundation click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper participates in Sandyford 5k Run 2019

EisnerAmper Ireland is proud to have been a participant in the 2019 Sandyford 5k Run, which took place on Thursday 26 September. The event is hosted by Dundrum South Dublin Athletic Club (DSDAC), in association with the Sandyford Business District and caters for walkers, joggers, fun runners and athletes.

From L to R back: Brian Frawley, Claude Makiesse, Jonathon Squire, Cian Collins, Warren Bridge & Tony Keegan. From to L to R front: Aideen Conneely & Sarah Ryan

The event attracted it’s largest number of participants this year since its first race in 2015. The race is organised to raise funds for the exciting new Sports Campus for the DSDAC. It was a fantastic opportunity to get a team together within the Firm and meet local business people in the community. To learn more about the Sandyford 5k Run, click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →Meet the Team!

Meet the Team! This month we welcomed 15 new joiners to the EisnerAmper Ireland office. Our new joiners will be working in the Financial Services, Tax and International Business Departments.

Our new colleagues have completed a two week induction programme, covering various topics ranging from technical, on the job and soft skills training, delivered by our HR Team.

To learn more about our staff, including our new joiners, click here.

From L to R: Dylan O’Neill, Jass Teh & Diana Ciubotariu

From L to R: David Molloy, Pearse OBrien, Robert Beverland, Sean Goodburn & Jennifer Thompson

L to R: Celina Dunne, Emma Hodgins, Agne Valinskyte & Hugh Kelly

We care about business and we care about the people we work with in business.

Our team includes people with multi-disciplinary backgrounds who bring fresh, candid and connected perspective to how we work. We strive to nurture and leverage the talent and unique ability of each individual member of our team. To read more about Life in EisnerAmper and about our career opportunities click here.

Contact Us

Latest News →VAT On Food Supplements

General VAT Treatment Of Food

The VAT treatment of food and drink in Ireland can vary depending on what is being sold and how it is being supplied to the customer. The majority of food sold in shops and supermarkets is at zero rate, while the reduced rate (13.5%) applies to certain baked items including crackers, bagels, cakes and plain biscuits, and the standard rate (23%) applies to various items, examples of which include ice-cream, chocolate biscuits, sweets and crisps. Hot food and food provided in the course of catering is liable to VAT at the reduced rate while food supplements are treated separately for VAT purposes.

More information on the VAT treatment of food can be found on the Revenue website here.

What Are Considered Food Supplements For VAT Purposes?

For VAT purposes, food supplements are items for human consumption which are not ordinarily considered to be food and which are marketed to the consumer as dietary supplements.

VAT On Food Supplements – Current Issues

As these items are not considered food they are subject to VAT at the standard rate, however, in 2011 Revenue issued guidance (eBrief No. 70/11) to the effect that vitamins and minerals, in either tablet or liquid form, and fish oils for human consumption are subject to zero rate VAT.

VAT On Food Supplements – Upcoming Change

In December 2018, Revenue issued new guidance which confirmed the removal of the zero rate concession for vitamins, minerals and fish oils. As of January 2020, these items will be subject to the standard rate of VAT. Revenue also confirmed that as well as food supplements such as those defined above, the standard rate of VAT also applies to sports nutrition supplements, slimming aids, and liniments, ointments and rubs made from food ingredients.

Source: revenue.ie.

VAT On Food Supplements – Potential Impact of Upcoming Change?

With the vitamin and mineral market in Ireland currently worth circa €37 million annually (source: Statista), the overall increased cost of the new VAT measures to the Irish consumer will be approximately €8.5 million per year. This figure is set to rise, as the Irish vitamin and mineral market has an expected compound annual growth rate of 1%.

How EisnerAmper Ireland Can Help

At EisnerAmper Ireland, our dedicated team of Tax professionals possess the knowledge and experience required to provide technical guidance and specialist advice on this and all other VAT and Indirect Tax related matters. We tailor our offering to your needs, ensuring you receive the best advice at the appropriate time.

Learn more about our outsourced Tax Services here.

Request a Callback

Request a Callback from our Tax specialists now.

Latest News →- ←« Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 36

- →Next Page »