EisnerAmper attends Help for Children London Benefit

On Friday, 30 November 2018, EisnerAmper Ireland’s Joseph Halligan joined Rob Mirsky, Managing Partner of the EisnerAmper UK office and Edo Pollack, Director of the EisnerAmper Israel office, at the Help for Children Annual London Benefit Dinner in the InterContinental, Park Lane, London.

Help for Children is a charity organisation which is run by leading members of the hedge fund industry. The charity focuses on protecting and healing children from the trauma of abuse. The event was a great success and was also a great chance to connect with our EisnerAmper Global colleagues. To read more about the Help for Children charity click here.

At EisnerAmper Ireland, we deliver solutions to support our community.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →Gender Pay Gap Reporting

Under legislation that came into effect in April 2017, UK employers with more than 250 employees are required to publish and report specific figures about their gender pay gap. The Irish government has recently published a similar draft bill (view the proposed Irish gender pay gap bill here), which is expected to be enacted in the near future and will make gender pay gap reporting a requirement for certain Irish businesses. The bill is currently before Dáil Éireann (in the third stage) and the status, in addition to the history, of the proposed gender pay gap bill can be accessed via oireachtas.ie.

We outline below some key information and points of note that organisations should take into consideration in their preparation for this potential new business requirement.

“Gender Pay Gap” Definition

According to the European Institute for Gender Equality, gender pay gap “represents the difference between the average gross hourly earnings of female and male employees.” Source: eige.europa.eu.

What Is Ireland’s Gender Pay Gap & How Do We Compare With The EU?

Eurostat’s 2016 Gender Pay Gap Statistics Report notes that the gender pay gap in Ireland is 13.9%, which means that on average women get paid €86.10 for every €100 paid to their male counterparts. Although Ireland ranks 11th of 28 in the EU (europa.eu, 2016), and is below the average of 16.2%, it is still some way off the lowest EU gender pay gap which was recorded in Romania with an average of 5.2%.

Gender Pay Gap vs Equal Pay

The gender pay gap is the disparity between average earnings of men and women in an organisation while equal pay means that men and women performing the same role must receive the same rate of pay. If a majority of senior positions in an organisation are filled by men (or women), there will be a gender pay gap, even if the equal pay laws have not been broken.

What Is Gender Pay Gap Reporting?

Gender pay gap reporting is the obligation to publish detailed annual reports highlighting an organisation’s pay differences across a range of metrics.

What Is The Objective Of Mandatory Gender Pay Gap Reporting?

The objective of mandatory gender pay gap reporting is to highlight any discrepancies that may exist between the average pay of male and female employees across medium-large sized organisations. Ultimately, according to the Department of Justice and Equality, the goal is to remove the barriers which prevent the advancement of full socio-economic equality for women.

Who Does The Gender Pay Gap Legislation Affect?

Initially, the proposed legislation will affect companies that have 250+ employees, although the government plans to eventually extend the obligation to organisations with 50+ employees.

When Will The Legislation Come into Effect?

A date has not yet been set, which should provide employers the opportunity to take steps to address requirements before reporting becomes mandatory.

What Information Will Likely Be Required In Your Gender Pay Gap Report?

Under the draft legislation, gender pay gap reports will have to include a wide range of statistics. When looked at in conjunction with the UK’s gender pay reporting requirements, it is likely that employers will have to report on the gender differences in:

- Gross hourly pay;

- Bonus payments;

- Part-time / temporary contracts;

- Benefits in kind; and

- Employees across four quartiles.

What To Do With Your Completed Gender Pay Gap Report

Similar to the UK, it is likely that completed gender pay reports will be required to be published on the company’s website and uploaded via an online portal, the exact details of which are yet to be revealed.

Non-Compliance With Gender Pay Gap Reporting Requirements

It is expected that fines will be levied against firms that fail to comply with their reporting obligations. Reputational damage may also potentially serve as a deterrent to non-compliance.

Ensure Gender Pay Gap Compliance

At EisnerAmper Ireland, our dedicated team of outsourced payroll professionals possess the tools and the expertise to analyse your payroll data and produce detailed reports highlighting the current gender pay gap in your organisation. From this, we can highlight key areas to address, which will allow your HR function to develop a strategy to address any imbalances and make year on year improvements in your gender pay gap report.

Learn more about our outsourced payroll services here.

Request a payroll quote or request a callback from our specialists now.

Request a Quote

Contact Us

Latest News →EisnerAmper Ireland hosts Invest in Ireland – Entry to Europe in Toronto with Fasken & Whitney Moore

On Thursday, 29 November 2018, EisnerAmper Ireland, Fasken and Whitney Moore hosted a breakfast briefing for Canadian-based global technology, resources and life sciences businesses and financial institutions expanding their operations into the European market.

The briefing was held in Fasken’s office in Toronto, Canada. The event was centred around using Ireland as as a base in order to access the wider European market. The panel discussed the topic from a wide variety of different angles including investment, legal, accounting, tax and marketing.

Speakers & topics

Speakers and topics included:

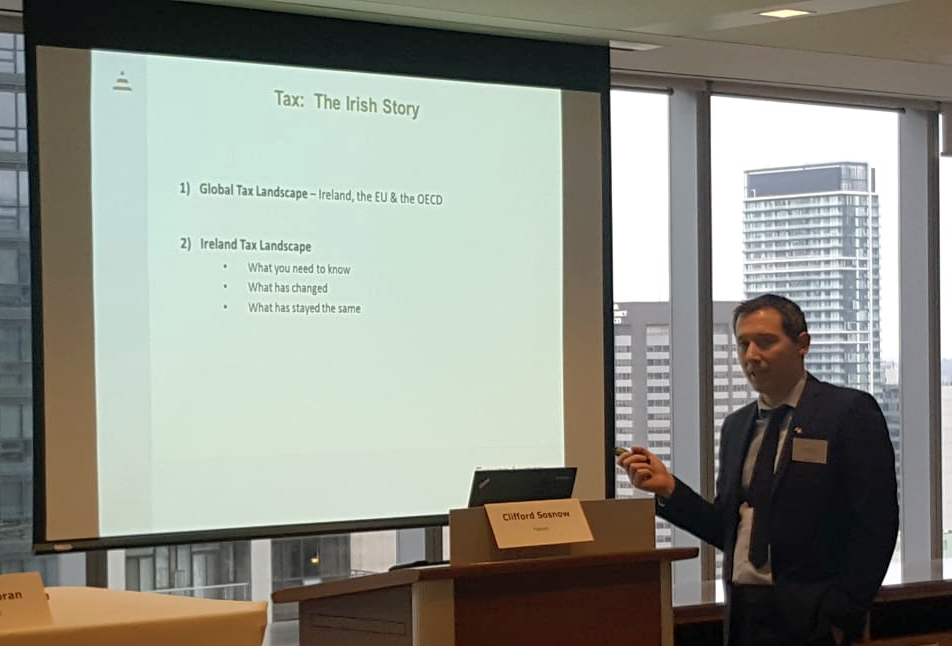

Clifford Sosnow, Partner, Fasken moderated the panel which discussed key considerations and reasons to invest in Ireland in addition to opportunities surrounding Brexit.

Brendan Ringrose, Partner, Whitney Moore, Dublin

Brendan specialises in advising on mergers and acquisitions, corporate transactions, fundraisings and commercial agreements. He provided insights into setting up in Ireland from a legal perspective.

Cormac Doyle, Tax Partner, EisnerAmper Ireland

Cormac is a Partner and head of the Firm’s tax team, leading a specialist team advising clients who are setting up and operating in Europe using Ireland as a base. He offered insights in relation to setting up in Ireland from a tax perspective.

Gavin Lee, Head of International Trade, EisnerAmper Ireland

Gavin is EisnerAmper Ireland’s Head of International Trade. He brings with him over 20 years industry experience in the financial services, life sciences and telecommunications sectors. Gavin shared his extensive international business experience, having been previously based in the South Pacific, and more recently the EMEA region.

Deirdre Moran, IDA Ireland

IDA Ireland, Ireland’s inward investment promotion agency is a non-commercial, semi-state body, promoting Foreign Direct Investment into Ireland through a wide range of services. Deirdre shared insights from her 7 years’ experience based in the United States and Canada advising high-growth companies and the emerging technology sector with regard to investing in Ireland.

Stephanie Lopinski, Director, Global Communications, SOTI Inc.

Stephanie is a passionate storyteller, brand ambassador and marketing executive who coaches and develops teams to results. Specialising in high-growth companies, she has 10+ years of experience working across worldwide communications, brand, events, social and digital marketing for industry leaders including BlackBerry, Toyota and the Government of Ontario. She currently serves as Director of Global Communications for SOTI, an enterprise mobility & IoT management software company. Stephanie will join the panel to provide further insights into how Canadian companies can transition into Ireland.

Cormac Doyle, Partner & Head of Tax at EisnerAmper Ireland discusses the tax considerations of entering the Irish market.

At EisnerAmper, we care about business and we care about the people we work with in business.

Our dedicated International Business team advises global technology and life sciences businesses, financial institutions and their advisors on internationalisation. The approach of our team is to look at the client through the prism of their business model and vision. We provide them with the local knowledge, ideas and support necessary to facilitate their European international trade planning and execution. For more information contact Cormac Doyle.

Contact Gavin Lee

Contact Cormac Doyle

Latest News →Jennifer Kelly nominated for the Irish Women’s Awards 2018

Jennifer Kelly, Partner and Head of Outsourcing at EisnerAmper Ireland, has been nominated for the Irish Women’s Awards 2018 in the Services to Accounting & Finance category. The awards ceremony will be held at the Crowne Plaza Dublin on Monday, 21 January 2019.

The Irish Women’s Awards aim to acknowledge and celebrate the success of women entrepreneurs, businesswomen, professionals, civil servants, women in uniform, charity workers and many more that contribute to making Ireland a greater place to live in. The awards embody the continuing strength and determination of women, honouring those who continue to thrive, excelling them to the forefront of their industries.

The finalists for this year’s awards include women from a range of different sectors including accounting & finance, law, medicine, government, technology and much more.

A spokesperson for the Irish Women’s Awards 2018 commented: “We are very happy to see the huge engagement of the Irish public who have gotten behind our nomination process wholeheartedly to vote for their favourite female personalities that have worked tirelessly to achieve their goals”.

“We hope that these finalists will inspire younger women to follow in their steps and we can’t wait to welcome meritorious individuals at the ceremony and celebrate with them in an enjoyable event. We wish all the finalists the best of luck.”

Jennifer Kelly is a Partner and Head of Outsourcing at EisnerAmper Ireland. Jennifer leads a specialist team in the delivery of company incorporations, set up and ongoing accounting and compliance services to corporates and financial services entities doing business in Europe through Ireland. Jennifer also chairs the firm’s Corporate Social Responsibility (CSR) Committee. To read more, click here.

At EisnerAmper, we care about business and we care about the people we work with in business.

The official press release along with a complete list of all nominees for the Irish Women’s Awards 2018 can be found here.

Latest News →EisnerAmper Ireland hosts INED Forum III 2018 with Insurance Ireland on SEAR

On Thursday 22 November 2018, EisnerAmper Ireland & Insurance Ireland hosted the third in a series of INED fora in the St. Stephen’s Green Hibernian Club, Dublin 2, the final gathering in 2018 of the Industry INED community under the auspices of the Insurance Ireland – EisnerAmper Ireland INED Forum.

The event focused on the potential impacts and implications, for the industry, of proposals which have been outlined in recent speeches by, amongst others, the Central Bank of Ireland’s Director of Enforcement (August 2018), the Director of Securities and Markets Supervision (September 2018) and more recently by the wider senior management team at the Central Bank’s conference on Culture, Diversity and the Way Forward (October 2018) referencing proposals for the adoption of a Senior Executive Accountability Regime, or “SEAR”.

This proposed regime would place obligations on firms and senior individuals within them to set out clearly where responsibility and decision-making lie for their business. The new regime is intended to be modelled on the UK’s Senior Managers and Certification Regime (SMCR).

Dave Montgomery, Partner, Head of Risk & Regulatory at EisnerAmper Ireland gave an introductory presentation outlining the background to the proposed SEAR regime and acted as the MC for the afternoon and the speakers included:

- Mary Fulton, INED

- Seamus Creedon, INED; and

- Jennifer Hoban, Insurance Ireland

EisnerAmper Ireland is delighted to be working with Insurance Ireland and their dedicated INED Council, supporting the delivery of their Annual INED Seminar in February and co-hosting a series of bespoke INED Fora throughout 2018. As the voice of insurance actively promoting the highest standards, Insurance Ireland represents 95% of the domestic market and more than 80% of Ireland’s international life insurance market. The Insurance Ireland INED Council promotes best practice for insurance industry INEDs in addition to acting as a sounding board for entities, organising appropriate training and acting as a networking hub.

At EisnerAmper, we deliver business & compliance solutions to make trade happen.

As Head of Risk & Regulatory at EisnerAmper Ireland, Dave Montgomery leads a team in the provision of regulatory, risk management, audit and advisory solutions to Insurers and Reinsurers operating in or through Ireland. As a former regulator with the Central Bank of Ireland, Dave supervised insurance and reinsurance firms and also worked on the development and implementation of the PRISMTM framework. If we can assist you or your business in any way, please contact Dave Montgomery.

Contact Dave Montgomery

The increased enforcement capabilities of financial regulators globally has led many (re)insurers to consider how they can best demonstrate the manner in which they satisfy their regulatory requirements in a cost-efficient and compliant manner. We provide specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements. To read more about our specialist Insurance Regulatory Compliance Services, click here.

Latest News →Cormac Doyle speaks at Thanksgiving Business Briefing with Tully Rinckey

On Thursday, 22 November 2018, Cormac Doyle, Partner, Head of Tax at EisnerAmper Ireland spoke at Tully Rinckey Ireland’s Thanksgiving Business Briefing at the Trinity City Hotel in Dublin’s City Centre. The title of the event was “Established for Business – Strategically Locating Your Company”. The panel of speakers discussed the advantages & disadvantages of establishing & streamlining business operations in another jurisdiction.

Tully Rinckey PLLC is a law firm offering legal services to corporations, governments, small businesses and individuals across the globe, with locations in the United States and Ireland. Other speakers included Conor Robinson, Partner, Tully Rinckey Ireland; Fintan McGovern, Director and Co-Founder, Firmwave; Joanne McEnteggart, Managing Director, Corporate and Institutional, First Names Group; and Eamonn Sayers, Manager, Guiness Enterprise Centre.

To read more about the event, click “View Details” here.

At EisnerAmper Ireland, we deliver business & compliance solutions to make trade happen.

Tully Rinckey Ireland Thanksgiving Business Briefing with Barry Crushell, Partner and COO (Europe), Fintan McGovern of Firmwave, Joanne McEnteggart of First Names Group, Conor Robinson, Partner, Tully Rinckey and Cormac Doyle of EisnerAmper. Photograph courtesy of Tully Rinckey Ireland.

Our dedicated International Business team advises global technology and life sciences businesses, financial institutions and their advisors on internationalisation. The approach of our team is to look at the client through the prism of their business model and vision, and to provide them with the local knowledge, ideas and support necessary to facilitate their European international trade planning and execution. For more information contact Cormac Doyle.

Contact Cormac Doyle

Latest News →EisnerAmper Ireland hosts The Academy 2018

The EisnerAmper Ireland Academy 2018, the Firm’s annual all-staff two-day residential training programme, was held for the seventh year running in Seafield Golf & Spa Hotel, Gorey, Co. Wexford, on 15 & 16 November 2018.

The residential programme is specifically designed for our professionals to accelerate their “on the job” learning and to facilitate EisnerAmper Ireland staff on the journey towards becoming not just great accountants but exceptional advisers and practitioners. Participants acquire the necessary core awareness, knowledge, skills and confidence to successfully further their careers in practice.

The theme of this year’s programme was ‘Delivering Quality Solutions’ and included workshops, technical training, team building and knowledge exercises reaffirming EisnerAmper Ireland’s commitment to achieving and maintaining consistent excellence in quality standards.

Speakers included Fergal Murray, former Guinness Brew Master; Joanne Powell, a Learning and Assessment Professional and Business School Accreditation Advisor with QED: The Accreditation Experts; and Peter Cogan, Partner with EisnerAmper US, Co-chair of the Firm’s Financial Services Group and Chairman of EisnerAmper Global.

Participants also enjoyed some downtime where they could avail of the award-winning facilities the hotel has to offer and also enjoyed a three-course meal in the Seafield Clubhouse restaurant.

We care about business and we care about the people we work with in business.

Our trainees are involved in all elements of practice management from day one. From the outset, trainees work closely with partners and senior management to deliver services to our key markets. This approach facilitates our trainees getting hands-on experience while also developing the core awareness, knowledge, skills and confidence to succeed in their careers. To learn more about our trainee programme, click here.

Latest News →Auto Enrolment – What Employers and Employees Can Expect

What Is Auto Enrolment?

Auto Enrolment is a retirement savings scheme which, if implemented, will be mandatory for all employees between the ages of 23 and 60, earning over €20,000 per annum who do not already contribute to a workplace pension. Launching in 2022 on a phased basis, it is expected that the government will incentivise the scheme by contributing €1 for every €3 saved by the employee.

Why Is “A New Automatic Enrolment Savings System” Being Explored?

According to the government only 35% of Irish private sector employees have a supplementary pension, which means that a significant percentage of the population will not have the adequate savings necessary to sustain their pre-retirement standard of living into old age. The concern is that the pension system in its current form is not sustainable and requires significant reform in order to meet the long-term demands of the working population. Auto Enrolment is one of the measures outlined in the Government’s “Roadmap for Pensions Reform” which sets out the actions required to overhaul the approach to providing for pension income in retirement.

Auto Enrolment – What Employers Can Expect

To minimise the potential increased administrative burden on employers when implementing Auto Enrolment, the Government has announced there will be supports available during the roll-out phase. Employers will be responsible for enrolling their employees into the scheme, and for remitting the pension contributions to a state-run ‘Central Processing Authority’ (CPA), although there are currently no plans to involve employers in the selection of their employees’ Registered Provider or savings fund option. Employers will have to match their employees’ contributions (up to 6% of pensionable pay, with a ceiling of €75,000) and their contributions will be deductible for corporation tax. According to the “Strawman Proposal”, penalties will be levied on employers who fail to implement the scheme, which could lead to prosecution for repeat offenders.

Auto Enrolment – What Employees Can Expect

Under the current proposal, employees can choose a preferred savings option from a range of Registered Providers, however, those who do not exercise this choice will be provided with a fund and provider by default. Although employees will be enrolled automatically, they will be permitted to opt-out at the end of a minimum period, which is currently proposed to be “during the 7th and 8th month of membership” (read the Strawman Proposal for more details). Importantly for employees, there will be a facility to transfer their account between employments.

Expected New Employer Tasks If/When Auto Enrolment Is Introduced

Based on the latest information, employers will be required to:

- Identify the employees eligible for enrolment;

- Arrange the deduction of employee contributions;

- Match the employee contributions; and

- Remit the payments to the CPA.

How EisnerAmper Ireland Can Help

At EisnerAmper Ireland, our dedicated outsourced payroll team combines in-depth knowledge of the Irish payroll landscape with market leading software to create solutions to meet our clients’ unique requirements. We leverage this expertise to support employers through all phases of Auto Enrolment, from initial implementation to the deduction and reporting of employee contributions.

Learn more about our outsourced payroll services here.

Request a payroll quote or request a callback from our specialists now.

Request a Quote

Contact Us

Latest News →EisnerAmper Ireland takes part in Run in the Dark 2018

On 7 November 2018, EisnerAmper Ireland joined thousands of runners to support ongoing research to find a cure for paralysis.

Team EisnerAmper was led by Brian Hillery, Partner, Advisory and also consisted of Barry Horan, Warren Bridge, Nina Zafra, Michéal Ó Cualáin, Matthew McCarthy, Stephen Murtagh, Dagan Morris, Zoe Moloney and Jonathon Squire. The Dublin event left from Custom House Quay at 8.00pm.

Run in the Dark is the main fundraiser for the Mark Pollock Trust, which believes we can cure paralysis in our lifetime. Unbroken by blindness in 1998, adventure athlete Mark Pollock was left paralysed in 2010. Now, with the team at the Mark Pollock Trust, he is exploring the intersection where humans and technology collide, catalysing collaborations that have never been done before and unlocking $ 1 billion to cure paralysis in our lifetime.

At EisnerAmper Ireland, we design solutions to support our community.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →

Jennifer Kelly attends Premier International Associates Conference, Barcelona

On Friday 26 October, Jennifer Kelly, Partner and Head of Outsourcing, EisnerAmper Ireland, travelled to Barcelona, Spain to attend the Premier International Associates Conference. Subjects discussed included digital strategy for accountants, IFRS & US GAAP convergence, succession planning for accountants and other trends across the finance landscape.

EisnerAmper Ireland is a member of Premier International Associates, a global network of accounting, tax, legal and business consulting firms. The bi-annual conference presents members with the opportunity to build relationships with member firms and to gain in-depth insights into technical updates through attending the presentations, Q&A sessions, group discussions and workshops offered by members.

At EisnerAmper, we design business & compliance solutions to make trade happen.

EisnerAmper Ireland’s International Business team assists clients to do business in Europe, using Ireland as a base, everyday. For more information, click here or contact Jennifer Kelly.

Contact Jennifer Kelly

Latest News →PAYE Modernisation

What is PAYE modernisation?

PAYE modernisation is a fundamental change to the current system of reporting PAYE deductions to Revenue and represents the most significant update to the PAYE system since its inception in 1960. The new regime is designed to meet the demands of today’s workforce by utilising modern communication technologies to enable “real time” reporting of employee’s payroll data. Traditional payroll returns, such as the P30, P46 and P35 will become obsolete, as will paper forms of P45 and P60.

The objective of PAYE modernisation

“The objective of PAYE Modernisation is that Revenue, employers and employees will have the most accurate, up to date information relating to pay and tax deductions. This will ensure that the right tax deduction is made at the right time from the right employees, and that employers pay over the correct tax deduction and contribution for every employee. This will improve the accuracy, ease of understanding, and transparency of the PAYE system for all stakeholders.”

(Source: Revenue.ie – PAYE Modernisation – Report on Public Consultation Process.)

The benefits of PAYE modernisation

For employers, reporting pay, tax and other deductions in real time (i.e. when the payroll is being processed) will alleviate the administrative burden associated with the processing of a payroll year-end. Changes to employee’s tax credits and rate bands will be automated which will eliminate the possibility of deducting an incorrect amount of tax.

Employees will benefit from the ability to view accurate, up-to-date information relating to their PAYE deductions anytime via their online Revenue myAccount. Real-time data will assist Revenue in ensuring that employees get the full benefit of their entitlements during the year, particularly where an individual has a number of employments.

How employers & payroll personnel can prepare for PAYE modernisation

Employers, and those responsible for the provision of payroll services, should review their current practices in readiness for the upcoming changes. As with all largescale changes, stakeholder engagement is key to ensuring that all those affected are aware of their evolving obligations. Payroll processes will need to be streamlined and a greater focus placed on quality, as the submission of payroll data must be made on, or before, the employee’s pay date.

New requirements arising from PAYE modernisation

The main requirements to ensure a frictionless transition include:

- Payroll software must be compliant with the new system;

- Employees will need to register for a Revenue myAccount to manage their tax affairs; and

- An accurate list of employees must be uploaded to Revenue via ROS.

How EisnerAmper Ireland can help

At EisnerAmper Ireland, our dedicated team of outsourced payroll professionals possess the tools and the expertise to process your payroll accurately and efficiently. We utilise market leading software to ensure compliance and our staff are highly trained and fully prepared to meet the challenges that PAYE modernisation may bring.

Learn more about our outsourced payroll services here.

Request a Quote

Request a payroll quote or request a callback from our specialists now.

Latest News →Roisin Jordan presents at Allinial Global International Tax Conference in Berlin

Roisin Jordan, Senior Manager and Head of Indirect Taxes at EisnerAmper Ireland spoke at the Allinial Global International Tax Conference in Berlin, Germany.

The conference was held from 21 – 23 October 2018. Roisin presented on behalf of their Indirect Tax Working group, outlining their expertise and the specialist services that they can provide to both Allinial Global member firms and their clients.

Allinial Global is an accounting firm association of legally independent accounting and consulting firms with offices in North America and throughout the world through international members and partnerships. Allinial present over 200 associate member events per year including conferences, training, leadership development and more. Read more about Allinial Global here.

At EisnerAmper, we design business & compliance solutions to make trade happen.

EisnerAmper Ireland’s Indirect Tax team provides advisory & compliance services to property investment companies, section 110 special purpose vehicles, financial services entities and international and Irish based corporates. To find out more about our Indirect Tax services, contact Roisin Jordan.

Contact Roisin Jordan

Latest News →- ←« Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 36

- →Next Page »