EisnerAmper joins LauraLynn for 280,000 steps in February

EisnerAmper Ireland is delighted to announce that we are partnering with LauraLynn Children’s Hospice as a Corporate Partner for the second year running, helping them to support children with life-limiting conditions and their families to live as fulfilling lives as possible.

EisnerAmper first partnered with LauraLynn Children’s Hospice in 2020, helping them to fundraise and support children and families from all 26 counties with the aim of enhancing the quality of life for families in their care – including physical comfort, health and well-being, as well as the emotional, social and spiritual aspects of care.

The first fundraising activity of the year that EisnerAmper is participating in is LauraLynn’s 280,000 steps in February. The charity initiative is running from the 1st to the 28th February and our staff members are being set the task of completing 280,000 steps over the 28 days and raising money for the charity through their individual JustGiving pages.

To learn more about LauraLynn or to make a donation, please click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper hosts wellbeing workshop with The Wellness Clinic

On Friday 22 January, EisnerAmper Ireland’s CSR Committee were delighted to host our second online wellbeing workshop with Niamh O’Connell from The Wellness Clinic on Zoom for all our staff members.

Our Firm is focused on providing a positive, healthy and safe working environment, as well as boosting the sense of wellbeing and productivity among our employees. The Firm’s wellbeing initiatives endeavour to foster a culture where we can focus on optimising individual and team performance while offering the tools, resources and guidance to support our employees journey.

The workshop, ‘Minding Your Mental Health’ discussed mindfulness, managing stress, dealing with anxiety and coping with panic attacks. Niamh practiced breathing techniques with staff and discussed how best to get back into a healthy work / life routine after Christmas. Following Niamh’s presentation there was time for an Q&A session to allow staff members to ask any questions they had regarding any of the topics.

To learn more about The Wellness Clinic, click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper Christmas Gift Boxes

EisnerAmper Ireland is delighted to have delivered gift boxes to every member of our team this week to help them get into the festive Christmas spirit.

The gift boxes are a gesture of thanks to all of our staff for their efforts working together as part of the EAI team during 2020. The gift box from The Book Resort comprised of all Irish made products, including Irish chocolate with a hand piped message from ‘Marlene’s Chocolate Haven’ in County Mayo, hot chocolate and marshmallow sets by ‘Brona’, a nollaig candle by ‘Milis’ with a lovely seasonal cinnamon scent, and a book of choice along with some other small Irish made gifts and a hand written card.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper hosts Virtual Christmas Party and ‘Art of Practice Awards’ for 2020

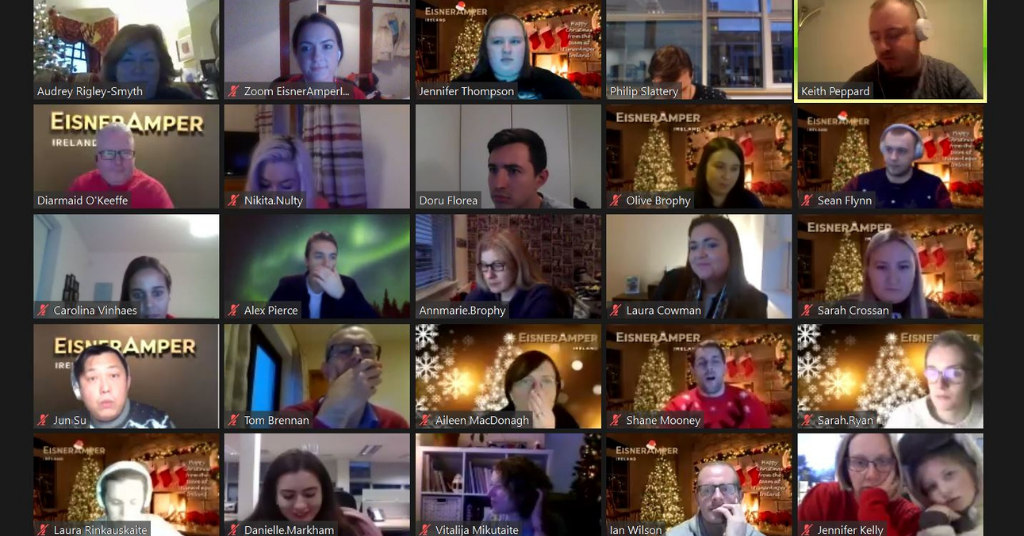

On Friday 11 December, EisnerAmper Ireland hosted its annual Christmas Jumper Day and Christmas Party. This year was slightly different with the Christmas party being held virtually on Zoom.

All staff were invited to wear a Christmas jumper to their home office on Friday to help support and raise awareness for Cystic Fibrosis Ireland. CF Ireland (CFI) is a voluntary organisation that was set up to improve the treatment and facilities for people with Cystic Fibrosis in Ireland. CF Ireland also co-operates with medical professionals to give maximum assistance to both parents and children/adults with Cystic Fibrosis.

The agenda for the evening included Christmas themed Musical Bingo and EisnerAmper Ireland’s fourth annual employee awards. Christmas themed Musical Bingo was hosted by Bingo with a Pep for all staff and their family members to enjoy. Classic Christmas songs were played by our host Keith Peppard and all staff were given bingo cards filled with the names of different songs from Keith’s playlists. While everyone danced and sang along, Keith played through his playlists and songs were marked off cards.

The awards were presented to EisnerAmper Ireland’s staff members who have demonstrated how they “love doing great work” in 2020. The winners were awarded with a crystal plaque to celebrate their achievements by Brian Hillery, Partner. The four areas that staff were asked to vote in were Quality, People, Operational Excellence and Growth, bringing to life the elements of our Firm’s Art of Practice. The winners for 2020 were:

- Quality Award

- People Award

- Operational Excellence Award

- Design Thinking & Growth Award

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper supports Blackrock College Union Webinar

On Friday, 4 December, EisnerAmper Ireland was delighted to support the Blackrock College Union Business Person of the Year Award webinar. Frank Keane, Partner at EisnerAmper Ireland, was MC for the event with former Irish Rugby International, Bob Casey, hosting a fireside chat with Irish professional golfer, Padraig Harrington.

At EisnerAmper Ireland, we love doing great work. We are specialist accountants, tax advisors and risk & regulatory experts playing a key role in bringing international trade to Ireland and advising Irish corporates. If we can help you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

Latest News →EisnerAmper Ireland takes part in Run in the Dark 2020

On 18 November 2020, EisnerAmper Ireland joined thousands of runners to partake in the virtual Run in the Dark, to support ongoing research to find a cure for paralysis.

This is the fourth consecutive year ‘Team EisnerAmper’ has participated in Run in the Dark, with this year being different to the rest. Due to the impact of COVID 19, Run in the Dark created an app to allow participants to run safely within their own area, but still virtually join thousands of others walking or running 5k or 10k around the world.

Recipes made by one of our staff members using the recipe section on the Run in the Dak app.

Run in the Dark is the main fundraiser for the Mark Pollock Trust, which believes we can cure paralysis in our lifetime. Unbroken by blindness in 1998, adventure athlete Mark Pollock was left paralysed in 2010. Now, with the team at the Mark Pollock Trust, he is exploring the intersection where humans and technology collide, catalysing collaborations that have never been done before and unlocking $ 1 billion to cure paralysis in our lifetime.

At EisnerAmper Ireland, we design solutions to support our community.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →

Azets Webinar: The UK & Ireland Trade Corridor – post-Brexit

EisnerAmper Ireland was delighted to participate in a Brexit webinar today hosted by our friends in Azets; an international accounting, tax, audit, advisory and business services firm. Today’s webinar, attended by more than 300 participants, focused on the UK and Ireland Trade Corridor – post-Brexit.

Frank Keane, Partner and Head of Client Internationalisation and Philip Slattery, Assistant Tax Manager at EisnerAmper Ireland, provided insightful contributions as guest speakers. Frank and Philip discussed challenges UK businesses will face post-Brexit and why UK firms might consider Ireland to future proof their access to the EU. Additionally, Frank and Philip provided an overview of Ireland’s compliance landscape and discussed areas for consideration for UK firms establishing operations in Ireland.

We would like to thank the Azets team who gave insightful contributions on today’s topics;

- Scott Craig, Partner and Head of VAT;

- Lucy Sutcliffe, Director of National Customs Duty; and

- Andy Dawbarn, VAT Partner.

Many thanks to the 300 plus participants who joined the webinar and the guests who contributed to our Q&A session.

How EisnerAmper Ireland Can Help

EisnerAmper Ireland’s multi-disciplinary team has a broad range of skill-sets and experience with backgrounds in the areas of banking, industry and accounting. Through our team’s understanding and experience we provide Audit, Tax, Risk & Regulatory, Accounting & Compliance and Advisory services to clients doing business, raising capital and investing in Ireland and Europe.

Contact Us

Latest News →EisnerAmper supports Insurance Ireland INED webinar series

EisnerAmper Ireland, in conjunction with Insurance Ireland, was delighted to host the final INED forum in the series for this year, this afternoon.

Today’s webinar focused on the end consumer and provided very informative insights into relevant consumer issues faced by both the Irish and UK markets. Frank Keane, Partner and Head of Client Internationalisation at EisnerAmper Ireland, moderated the event. We would like to thank Moyagh Murdock, CEO at Insurance Ireland for setting the scene, and to thank our panellists for their insightful contributions:

- Aaron Keogh – Managing Director, Vhi Healthcare Dac; and

- David Clements – Partner, Risk Advisory, Delitte UK.

Many thanks also to the participants who joined the webinar and who contributed to our Q&A session.

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

At EisnerAmper, we design and deliver specialist Services and Solutions for Business in the areas of Governance, Risk and Compliance. In this regard, if we can assist you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

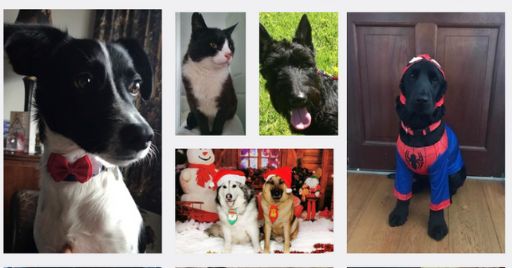

Latest News →EisnerAmper hosts Pet Corner Competition

This week, EisnerAmper Ireland’s CSR Committee were delighted to host an online Pet Corner Competition for all our employees and their pets to participate in.

Studies say that employees who bring their pets to work often lead more productive and engaged work lives. They are often happier and less worried throughout the day. Although we don’t bring our pets to the office, while working from home we have the pleasure of having our pets to keep us company. Some of the perks of having our pets at home while we work include; reducing stress, promoting creativity and creating happiness.

EisnerAmper Ireland wanted to celebrate our pets and therefore created a ‘Pet Corner Competition’. The CSR Committee asked staff members with pets to send in a picture of their furry friend. All of our entries were posted to our internal hub for staff members to vote for their favourite picture and the pet with the most votes won a small prize.

The competition winner – Mylo

To learn more about our CSR initiatives, click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →Central Bank of Ireland – Thematic Review of Fund Management Companies

Central Bank of Ireland – Thematic Review of Fund Management Companies

On Tuesday, 20 October 2020, the Central Bank of Ireland (Central Bank) published the findings of its thematic review of Irish Fund Management Companies’ (FMCs) governance, management and oversight. The Central Bank’s FMC Framework (Framework) was first introduced in 2017 for firms seeking new authorisation and was extended to existing firms in mid-2018. The Framework, underpinned by legislation designed to deliver investor protection, market integrity and systemic resilience, was introduced to provide increased clarity as to the standards to be met by FMCs. The Framework provides a strong basis for firms to identify and retain the level and nature of resources needed to put in place the required governance, management, systems and controls.

The findings of the thematic review, which are summarised below, noted that a significant number of previously authorised FMCs had not fully implemented the Framework.

EisnerAmper’s Risk & Regulatory team, led by Tom Brennan, Partner, advises FMCs on risk, regulatory and compliance-related matters. For more information on our services, please click here.

Thematic Review – Summary of key findings:

- Resourcing:

- According to the Central Bank, several FMCs, who were authorised prior to CP86 (Consultation on Fund Management Company Effectiveness-Delegate Oversight) taking effect, had not increased their resources adequately to ensure effective implementation of the Framework. As such, the Central Bank expects a minimum of three full-time employees (FTEs) in all FMCs, each of whom should be suitably qualified and of appropriate seniority to fulfil the role. This FTE requirement is a minimum expectation and only relevant to the smallest and simplest of entities.

- Larger firms are expected to have greater levels of resources in place, depending on the nature, scale and complexity of their operations.

- The Central Bank also expects “all but the smallest firms” to have a CEO responsible for the day to day running of the business.

- The review noted that 28% of FMCs had instances where an INED had a tenure exceeding 10 years. The Central Bank expects tenure and ongoing independence to be considered as part of the Organisational Effectiveness (OE) Director’s review of board composition.

- Designated Persons: The review also identified shortcomings in how the Designated Persons (DP) role is discharged including poor quality of reporting to the Board, inadequate challenge of delegates, insufficient review of delegate reports and insufficient time committed to the role.

- Delegate Oversight: Several deficiencies were identified in relation to delegate oversight, including:

- Some FMCs could not evidence compliance with Central Bank expectations in terms of initial and ongoing due diligence performed on delegates;

- Where reliance was placed on the policies and procedures of group/delegates, not all FMCs could evidence review of the policies and procedures;

- Some firms did not properly document service level agreements (SLAs) with regard to delegated activities; and

- In some cases, delegate reports were not of sufficient quality to allow for a meaningful review of the situation by the FMC.

- Risk Management Framework: Shortcomings were identified in the risk management framework of several FMCs, whereby many firms did not have:

- An entity specific risk management framework;

- An entity specific risk register; and

- A defined risk appetite.

- Board approval of new funds: Some FMCs under review were unable to demonstrate Board approval for the launch of sub-funds. Additionally, there was often a lack of evidence of Board discussions in relation to setting or agreeing the proposed strategy of the fund prior to submission of the application to the Central Bank.

- Organisational Effectiveness Director: Certain weaknesses were identified in how the Organisational Effectiveness (OE) Director executes the role in many FMCs, including:

-

- The OE Director not being able to evidence that meetings took place;

- The absence of formal records of meetings with Designated Persons;

- An absence of formal reporting to the Board (principally in the area of resource evaluation); and

- A lack of consideration given to conflicts of interest and personal transactions.

- Gender Balance: A substantial gender imbalance on the Boards of FMCs was noted in the review with only 16% of director roles held by women.

Actions Required:

The Central Bank requires all FMCs to assess their operational, resourcing and governance arrangements against all relevant rules and guidance, taking into account the findings of its thematic review. FMCs are required to develop and progress individual action plans to make the necessary changes to ensure full and effective embedding of all aspects of the Central Bank’s requirements and related guidance. These assessment and implementation plans must be approved by the board of directors of the FMC by the end of Q1 2021 and should at a minimum include the following:

- The time commitment, skills and expertise of available resources;

- The FMC’s retained and delegated tasks, including how ongoing independent challenge of all delegates can be ensured;

- The tasks required by the framework, including those that must be completed on a fund by fund basis;

- How resources and operational capacity will need to increase to take account of any increase in the nature, scale and complexity of the funds under management since authorisation or the last time the FMC critically assessed its operations; and

- How resources and operational capacity will need to increase to deal with a market and/or operational crisis.

How EisnerAmper Ireland can help

Our Risk & Regulatory team, led by Tom Brennan, advises financial services providers on risk, regulatory and compliance-related matters. Our services include:

- Supporting organisations throughout the regulatory engagement lifecycle;

- Provision of outsourced compliance services;

- Provision of bespoke board support and training;

- Designing and developing integrated risk and compliance frameworks;

- Preparing compliance briefings for discussion with the board covering new / pending legislation, marketplace intelligence, regulatory sanctions and impacts thereof;

- Supporting the board in responding to and implementing any changes required relating to evolving needs.

Learn more about our Risk & Regulatory Services here, alternatively, request a callback from our Risk and Regulatory team now.

Authors

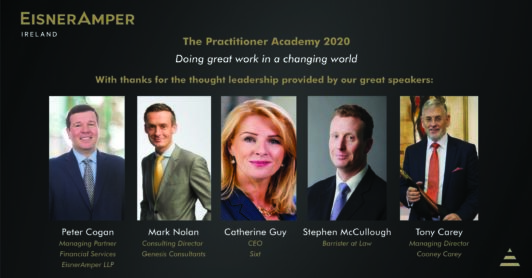

EisnerAmper Ireland hosts The Practitioner Academy 2020

The EisnerAmper Ireland Academy 2020, the Firm’s annual all-staff training programme, was held for the ninth year running on Thursday, 15 October. This year we were adapting and innovating to our changing environment and hosted our first Virtual Academy. The “Practitioner Academy” focused upon developing great practitioner skills to enable us to do great work for our clients in a changing world. We had an action packed line up of keynote speakers and thinkers, skills workshops, break-out and plenary sessions.

The Academy is specifically designed for our professionals to accelerate their “on the job” learning and to facilitate their journey towards becoming not just great accountants but exceptional advisers and practitioners. Participants acquire the necessary core awareness, knowledge, skills and confidence to successfully further their careers in practice.

The Practitioner Academy guest speakers.

The theme of this year’s programme was ‘Doing great work for our clients in a changing world’ and included workshops, technical training, team building and knowledge exercises reaffirming EisnerAmper Ireland’s commitment to achieving and maintaining excellence in everything we do. The workshops encouraged our staff to develop their design thinking skills and their self-awareness.

Our staff attendees at our virtual Academy.

We would like to thank our guest speakers for their insightful contributions:

- Mark Nolan, Consulting Director, Genesis Consultants – Thoughts on our rapidly changing environment and the future of work;

- Catherine Guy, CEO Sixt, FAI Board, former Managing Partner, Byrne Wallace – Doing great work – Practitioner & client perspectives;

- Tony Carey, Managing Director, Cooney Carey – Skills and strategies for successful negotiation;

- Peter Cogan, Managing Partner, EisnerAmper LLP – Strategy & growth insights; and

- Stephen McCullough, Barrister at Law – Applying the Principles of Natural Justice.

Guest speaker Catherine Guy presenting to our staff members.

We care about business and we care about the people we work with in business.

Our trainees are involved in all elements of practice management from day one. From the outset, trainees work closely with Partners and Senior Management to deliver services to our key markets. This approach facilitates our trainees getting hands-on experience while also developing the core awareness, knowledge, skills and confidence to succeed in their careers. To learn more about our trainee programme, click here.

Latest News →UK Resident Directors

Brexit – Implications for UK Resident Directors of Irish Companies

On 31 December 2020, the transition period between the UK and the EU will come to an end. If thereafter no agreement is in place, Irish companies which have UK resident directors may need to take action to ensure continued compliance with Section 137 of the Companies Act 2014. This is the requirement to have at least one EEA resident director. The EEA is the European Economic Area comprising all EU member states, in addition to Iceland, Liechtenstein and Norway.

In the event of a hard Brexit, an Irish company which currently has a UK resident director fulfilling this requirement should consider replacing the director or appointing an additional director who is resident in the EEA. In the event that a company does not have an EEA resident director, it can avail of one of two exemptions:

- Secure a Section 137 Non-EEA Resident Director Bond

A company can put in place a Section 137 Bond to the value of €25,000 to cover a failure by the company to pay a fine or penalty in respect of offences under the Companies Act 2014 and certain offences under the Taxes Consolidation Act 1997. The bond, which costs €1,750, needs to be put in place for a minimum two year-period.

- Apply for a Section 140 Certificate

A second option is for a company to apply to the Irish Revenue Commissioners and Companies Registration Office for a Section 140 Certificate confirming the company has a real and continuous link with one or more economic activities that are being carried on in the State.

Implications of EEA Resident Director Non-Compliance

Failure to meet the EEA Resident Director requirements is a criminal offence and could lead to a fine of up to €5,000. Additionally, under Section 725(1)(a) of the Companies Act 2014, the Companies Registration Office has the power to strike companies off the register if they believe them to be in breach of Section 137(1) of the Companies Act 2014.

How EisnerAmper Ireland can help

Although the deadline is fast approaching, there is still time to act. If your company is relying on a UK resident to fulfil the EEA resident director requirement and would like to discuss the options available, please contact Karen Moloney, Senior Manager, Accounting Tax & Compliance.

Authors

- ←« Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 39

- →Next Page »