Are you ready for the amendments to FRS 102?

What is FRS 102 and when is it applied?

Irish company law requires directors of companies incorporated in Ireland to prepare entity financial statements in respect of each financial year. Such financial statements must be prepared either in accordance with:

- International Financial Reporting Standards (‘IFRS’)

IFRS are published by the International Accounting Standards Board (IASB), as adopted by the European Union. Companies with debt or equity securities listed on a regulated EU market are required to be prepared in accordance with IFRS. Commonly large, listed firms or those seeking global investment prepare financial statements under IFRS.

Or as

- Companies Act Financial Statements

These are prepared in accordance with the accounting and disclosure requirements of Irish company law and with the Financial Reporting Standards (‘FRS’) published by the Financial Reporting Council (‘FRC’), the accounting standard setter for both Ireland and the UK. Commonly small and medium sized entities prepare financial statements under FRS 102 as it is less complex to apply than IFRS.

FRS 102, (”FRS102 The Financial Reporting Standard applicable in the UK and Republic of Ireland’) is the principal accounting standard in the Companies Act financial reporting regime. It is largely based on IFRS for SMEs but with significant adaptations for UK & Ireland.

It is subject to periodic review by the FRC. The most recent review in 2024 introduced significant changes which are mandatory for accounting periods beginning on or after 1 January 2026.

What are the updates to FRS 102?

The periodic review 2024 introduces significant amendments to the following sections:

- Section 20 Leases; and

- Section 23 Revenue from Contracts with Customers.

In addition, incremental improvements and clarifications have been made throughout the text of FRS 102 to align the standard with the latest international accounting standards (i.e. IFRS) in certain respects, and to include new and additional guidance to make the requirements easier to understand and apply consistently.

When the amendments are effective

The September 2024 edition of FRS 102 will be mandatory for accounting periods beginning on or after 1 January 2026.

Impact of the amendments to Section 20 Leases

The amendments to Section 20 Leases are based on the principles of IFRS 16 Leases and consequently, for lessees, the distinction between operating and finance leases is removed. This means that the majority of leases will be recognised on-balance sheet.

While lessor accounting remains largely unchanged, the amendments have a significant impact on the recognition, measurement, presentation and disclosure requirements of leases for lessees.

In summary, lessees will be required to:

- Identify lease arrangements by assessing whether a contract is, or contains, a lease.

- At the commencement date of the lease, measure the lease liability at the present value of the lease payments that are not paid as at that date. The calculation of the lease liability requires a suitable discount rate with which to discount the relevant cash flows.

- Measure the right of use (“ROU”) asset at an amount equal to the lease liability, adjusted by the amount of any prepaid or accrued lease payments.

- Depreciate the ROU asset, generally over the life of the lease.

- Accrue interest on the lease liability at the rate implicit in the lease. If that rate cannot be readily determined, the lessee shall choose to apply either the lessee’s incremental borrowing rate or the lessee’s obtainable borrowing rate – to reflect the financing of the ROU asset.

- The discount rate is the periodic rate of interest as described above, the determination of which can take significant judgment.

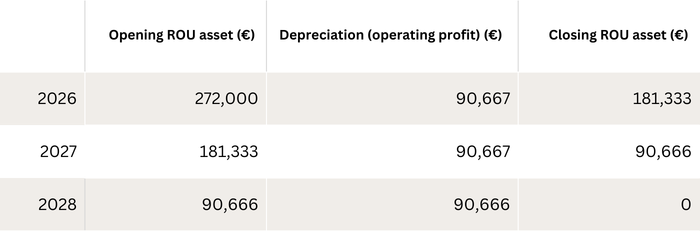

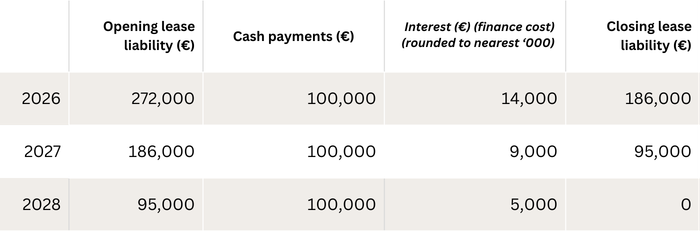

Illustrative example

Lease term: 3 years

Annual payment payable in arrears: €100,000

Discount rate: 5%

- Indicative present value of ROU asset and lease liability at initial recognition: €272,000. [Present value of lease payments of €100,000 over 3 years at 5%]

Impact of the amendments to Section 23 Revenue from contracts with customers

Section 23 Revenue from Contracts with Customers of FRS 102 was completely rewritten as part of the periodic review 2024 to be based on the principles in IFRS 15 Revenue from Contracts with Customers.

Revenue recognition model

The updated Section 23 replaces the previous risks-and-rewards-based revenue model with a single, principles-based framework focused on the transfer of goods or services to customers, aligning more closely with IFRS 15.

To apply the model, an entity shall take the following steps:

Step 1 – Identify the contract(s) with a customer;

Step 2 – Identify the performance obligations in the contract;

Step 3 – Determine the transaction price;

Step 4 – Allocate the transaction price to the performance obligations in the contract; and

Step 5 – Recognise revenue when (or as) the entity satisfies a performance obligation.

Many contracts will have a single performance obligation. However, when a contract has more than one performance obligation the subsequent steps of the revenue recognition model are designed to ensure that the revenue associated with each performance obligation is recognised at the appropriate time.

There are more disclosure requirements in the new Section 23 which are intended to provide more useful information to users of financial statements about the nature, amount and timing of revenue and cashflows arising from an entity’s contracts with customers.

Entities will need to reassess the accounting treatment of revenue contracts. The application of Section 23 will affect contracts with bundled goods and services, variable consideration, warranties, customer options, financing components and principal vs agent arrangements, as well as obligations satisfied over time.

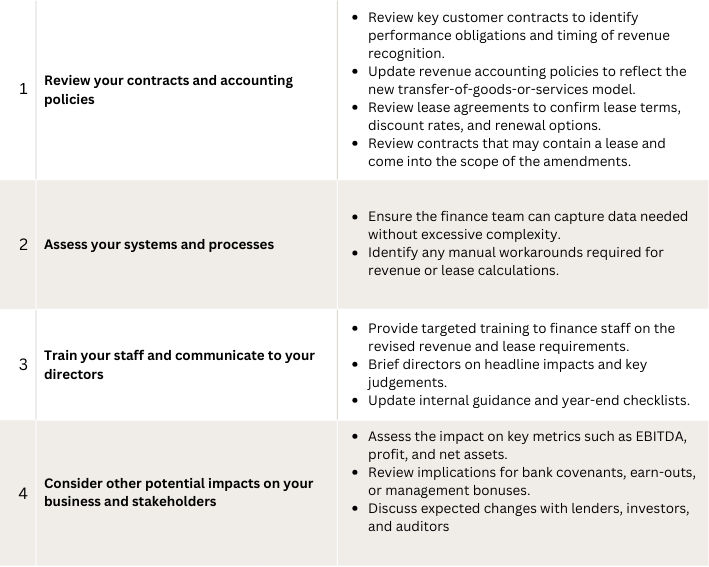

How can you ensure you are prepared for these changes?

To prepare for the amendments, Finance teams should assess how the revised requirements, particularly on revenue recognition and leases, affect existing contracts, accounting policies, systems, and KPIs.

If you would like to have an initial conversation about FRS 102 changes and the potential impacts on your business or if you need specific advice or assistance in respect of the above requirements, feel free to reach out directly. My contact details are as follows: Gavin Redmond on +353 1 2933471 or gavin.redmond@eisneramper.ie

Authors

Stepping In, Standing Strong: How Interim Expertise can strengthen your Finance Function

In today’s dynamic financial landscape, regulated financial service providers face increasing pressure to maintain financial resilience, regulatory compliance, and strategic clarity – even when unexpected challenges arise. One such challenge is an unexpected absence, vacancy or supplemental resource requirement in the Finance function.

Navigating Uncertainty – How we have helped

At EisnerAmper Ireland (‘EAI’) our Interim Finance Solutions team ensure continuity, confidence, and compliance when resources are needed. Here’s how we’ve supported our clients:

Case Study 1: Immediate Response to an Unexpected Absence

A credit union experienced the sudden departure of its Head of Finance, leaving a gap in leadership and oversight at a crucial time. With no internal successor ready to step in, the board needed urgent support.

We deployed an experienced finance professional to step into the role immediately, working closely with the existing finance team and under the direction of the board. Key outcomes included:

- Ensuring all financial reporting and regulatory submissions were completed on time.

- Identifying and mitigating financial and operational risks.

- Maintaining member and stakeholder confidence during the transition.

This collaborative approach ensured the client remained compliant and operationally stable while planning its next steps

.

Case Study 2: Financial Resource Secondment

EAI is currently appointed as a key financial resource in a bespoke regulated financial services company. Our client elected to engage a secondee resource rather than recruit an in-house resource. Under this arrangement, we provide ongoing support on a ten-day-per-month basis delivering the day-to-day financial management activities of the company.

Our Interim Finance Solution team provides:

- Flexible and experienced financial resource to manage the day-to-day financial activities of the firm.

- Preparation of quarterly management reports and CBI regulatory reports.

- Periodic reporting to the Board on the company’s financial position.

- Preparation of Group Reporting.

Our approach allows the client to ensure adequate controls and processes are in place and ensure continued compliance with regulatory requirements. We continue to support our client in delivering their strategic and regulatory commitments.

Advantages of Interim Financial Support

- Continuity: Keeps financial operations running smoothly during leadership gaps.

- Compliance: Ensures regulatory deadlines and reporting standards are met.

- Confidence: Reassures boards, regulators, and other key stakeholders that financial stewardship is in safe hands.

- Flexibility: Adapts to your businesses size, structure, and strategic needs.

Whether you’re facing an unexpected vacancy or planning a leadership transition, our Interim Finance Solutions team provide the expertise and stability required to keep your business on track. We offer experienced professionals who can step into key roles on a flexible basis ranging from days, weeks or months depending on your needs. Our interim resources provide the necessary skills and expertise to achieve your objectives. Whether it is a short-term gap or a longer-term need our professionals are equipped to add value from day one.

If you have a finance resource requirement, and would like to explore your options, we invite you to contact our team for more information.

Audrey Rigley-Smyth on +353 1 2933477 or audrey.rigley-smyth@eisneramper.ie

Frank Keane on +353 1 2933450 or frank.keane@eisneramper.ie

Authors

Audrey Rigley-Smyth

Director Governance,Risk & Compliance:Risk & RegulatoryCarmanhall Road

Sandyford

Dublin, D18 CA22

Ireland

The content above is provided for general information purposes only and is not intended to provide, nor does it constitute, professional advice on any particular matter. If you would like more information or would like to discuss any of the topics raised above, please contact the author(s).

EisnerAmper Ireland and IADT Launch New Financial Services Management, Governance & Risk Course

EisnerAmper Ireland is pleased to announce that a new Level 9 course, “Financial Services Management, Governance & Risk”, designed in partnership with the Institute of Art, Design and Technology (IADT) has launched.

The course has been developed under the framework of the Memorandum of Understanding entered into between EisnerAmper Ireland and IADT in April 2025 and is designed for those working in or aspiring to work in the financial services sector.

This Level 9 course will equip participants to be critically aware of how to structure effective governance, educate others on managing risk, and be critically aware and technology-enabled to meet future needs.

The launch of this course represents an important milestone in our collaboration with IADT, reflecting our commitment to supporting skills development and innovation within Ireland’s financial services sector.

Industry Expertise at the Core

With tuition from faculty members at IADT and professionals from EisnerAmper Ireland, participants will benefit from real-world insight into governance, regulation, and risk management. Students will engage with executives who work directly with evolving regulatory frameworks and best practices across the sector. Participants will also work with FinReg, the leading development platform for solving Governance, Risk & Compliance (GRC) challenges, reinforcing the programme’s practical and technology-enabled approach.

A Partnership with Purpose

Our partnership with IADT reflects our shared commitment to delivering meaningful, practical, and future-focused learning opportunities. With modules delivered by EisnerAmper Ireland professionals, learners gain access to current market thinking, regulatory context, and hands-on application.

Frank Keane, Partner and member of the Board of EisnerAmper Global said

“The opportunity to collaborate with IADT to design and deliver this programme aligns strongly with our Firm and the EisnerAmper Global network – we are deeply committed to building the right skills to meet the future needs of Ireland’s Financial Services sector.

At EisnerAmper Ireland we are proud of our focus on learning and development at all levels of our Firm. This programme takes that focus to the sector at large and offers a knowledge exchange between our professionals and the sector’s leaders of tomorrow. We are proud to be involved and look forward to learning as much as teaching.”

We look forward to welcoming participants to this innovative programme and to continuing our collaboration with IADT in support of developing the requisite skills that will enable Ireland’s financial services ecosystem to continue to thrive.

Learn more or apply here: https://iadt.ie/courses/financial-services-management-governance-risk/

Learning & Development →EisnerAmper Ireland Academy 2025: Owning Your Art of Practice

Last month, EisnerAmper Ireland hosted our annual EAI Training Academy 2025, part of our Learning and Development programme. The Academy is designed to support our people, build their skills, nurture professional growth, and enhance career development.

This year’s theme, Owning Your Art of Practice, encouraged our team through the lens of our Learning and Development Framework, the ‘Art of Practice’ to reflect on how their individual choices, habits, and daily interactions shape both their professional growth, personal brand and reflects and contributes to EisnerAmper’s brand.

Throughout the day in the tranquil surroundings of Kilruddery House, team members explored key professional development areas, including:

- Defining what each of us wants to be known for and who we want to influence.

- Understanding how the Art of Practice integrates into our day-to-day roles.

- How to use the skills in the Art of Practice through everyday interactions to build strong client relationships, enhance your personal brand which in turn enhances the Firm’s brand.

- Reflecting on personal strengths and decision-making through interactive exercises.

The programme featured two plenary sessions.

The first, ‘Identity, Impact & Influence – A Brand Journey – One Day at a Time’ highlighted the evolution of brands and how individual contributions shape the Firm’s reputation.

Peter Cogan, Managing Partner, Eisner Advisory Group LLC, Eithne Harley, Consultant and former Marketing Director, Accenture, and Diarmaid O’Keeffe, Partner and Head of Audit at EisnerAmper Ireland, shared insights from their experiences as leaders, emphasising the impact of personal visibility, professional choices, and participation in extra-curricular activities.

A series of practitioner-led workshops gave participants practical insights into the nine drivers of the Art of Practice, helping them apply these learning to their current roles and future career paths.

A fireside chat with Michael Doyle, CEO of Ivernia Insurance, focused on career development, personal brand, and professional habits. Michael shared his journey, from early career decisions through to leadership roles, highlighting how consistent choices, continuous learning, and self-awareness contribute to personal and organisational success.

The day concluded with a Johari Window exercise, reinforcing communication, team dynamics, and self-awareness. The Academy 2025 empowered our team to own their own Art of Practice, supporting career growth and strengthening the Firm’s collective expertise. A relaxing team dinner that evening was the perfect end to a great day of reflection and connection.

At EisnerAmper Ireland, we are deeply committed to helping our people learn, grow, and achieve their professional goals.

If you’re looking to build a rewarding career in accounting, audit, advisory or tax, and want to be part of a team that invests in your development, we’d love to hear from you!

Explore our current career opportunities: eisneramper.ie/careers

Learning & Development →Navigating a Central Bank Risk Mitigation Programme: A Practical Guide

The Central Bank of Ireland (Central Bank) takes an outcome focused, risk-based approach to supervision as outlined in their “Our Approach to Supervision”, which was published alongside its Regulatory & Supervisory Outlook Report 2025.

RMP’s are part of the Central Bank’s Supervisory Toolkit and may be used as an intervention arising from their supervision.

If you are a Board Chair, CEO, or other senior executive who has received a RMP you may be trying to understand how to respond effectively which is critical, not only to meet regulatory expectations but also to safeguard your organisations reputation and resilience.

Drawing on years of experience advising boards and executive teams, we’ve developed a practical framework to help leaders like you navigate the RMP process with confidence and clarity. In this article, I’ll outline key steps to take, common pitfalls to avoid, and how to turn regulatory scrutiny into an opportunity for strengthening governance and risk management.

Why is Supervision necessary?

Financial regulation is important and necessary, but, on its own, it is not enough to protect members, consumers and investors, keep firms safe and stable, maintain trust in the financial system, and support overall financial stability, i.e. the Central Bank’s Safeguarding Outcomes.

That’s why supervision is also essential. Supervision means the Central Bank will actively work with financial firms, analysing their activities and keeping a close watch to make sure that regulations are followed and risks are mitigated. This approach ensures that not only are regulations put into practice, but the support is there to check that they are working as intended, and action is taken when they are not.

By taking an outcome focused, risk-based approach the Central Bank can communicate its supervisory concerns to sectors and firms and highlight the outcomes expected and the timelines for them to be achieved.

Why does the Central Bank issue a Risk Mitigation Programme (RMP)?

If a firm is found to have issues or concerns in high-risk areas, for example, poor governance, weak financial controls, or inadequate third-party risk management, the Central Bank may issue a Risk Mitigation Programme (RMP). A RMP is a formal set of actions a regulated firm must take to fix those issues. It includes:

- What needs to be done.

- Who is responsible.

- When it must be completed.

This helps ensure the firm:

- Protects its members, customers and investors.

- Stays financially sound.

- Maintains trust in the financial system.

- Supports overall financial stability.

When might an RMP be issued?

A RMP may be issued:

- After a supervisory review or inspection.

- If the firm’s regulatory risk profile increases.

- When there are concerns about compliance, resilience or governance.

- If the firm’s actions could impact on the wider financial system.

How to respond to the Central Bank’s Risk Mitigation Programme?

Outcome focused and risk-based supervision remains fundamental to the Central Bank’s approach and any supervisory concerns will be communicated to sectors and firms. This may take the form of, for example, a ‘Dear CEO/Chair” letter, issuance of a risk mitigation programme (RMP) requiring a firm to prepare a skilled report, or at the higher end of the Central Bank’s escalation toolkit, the utilisation of direction-making powers, including enforcement actions. Firms must ensure they take appropriate risk mitigation actions to address the issues identified and the desired outcomes expected. Set out below is a practical framework to help you navigate the RMP process:

- Carefully review the RMP letter – it will outline the specific weaknesses identified, the required actions, desired outcomes and the deadlines.

- Engage and Clarify – if you are unclear about any part of the RMP, engage your Central Bank supervisor for clarification.

- Conduct a Gap Analysis – compare the Central Bank’s expectations with your current frameworks, policies and practices. Focus on the Central Bank’s identified weaknesses and desired outcomes in addition to regulatory requirements, guidance and best practices.

- Identify areas where your firm falls short and need enhancement.

- Develop a comprehensive remediation plan.

- Assign responsibilities.

- Board – Clearly communicate to the Board what their responsibilities are in respect of the RMP.

- Project Manager – assign a project manager responsible for planning, executing and closing the project considering the weaknesses identified, regulatory compliance. requirements, the Central Bank’s expected outcomes together with internal and external timelines.

- Action Owners – ensure detailed actions have a clear owner within the business to drive the remediation actions in line with desired outcomes.

- Set internal deadlines – that will ensure that internal reviews and reporting requirements are met in advance of the Central Bank’s deadlines to allow for review and adjustments.

- Document everything – maintain a clear audit trail of decisions, actions and communications.

- Ensure the issues and concerns – identified by the Central Bank in the RMP letter are appropriately strengthened via the remediation actions identified in your plan and are aligned with regulatory requirements and the Central Bank’s desired outcomes.

- Develop a comprehensive remediation project management cadence:

- Ensure there are internal structures for progressing the remediation plan including regular project touch points and regular internal progress reporting.

- Provide regular updates to the Central Bank on progress and where required submit evidence of the remediation progress which may include, for example, evidence of updates to policies, training records, system changes or audit results.

- Should you hit a roadblock or need more time, communicate early and clearly with the Central Bank. Be transparent about challenges or delays and propose realistic solutions. Transparency builds trust.

- Make sure responses are well-supported, accurate and aligned with regulatory expectations.

- Embed the Central Bank’s desired outcomes – into your systems and controls and ensure it is aligned with identified weaknesses, regulatory requirements, guidance, best practices and the Central Bank’s desired outcome.

- Be prepared for a follow-up. The Central Bank may undertake a follow-up inspection or request additional documentation.

- Be ready to demonstrate – how changes have been embedded and made operational in addition to how they are monitored and overseen to reinforce the changes and avoid further risk

If you are a Board Chair, CEO or other senior executive who has received a RMP and would like to talk through how you can best organise your team to respond to it, I’m happy to have a conversation with you, on a no obligations basis, to help guide you on those first steps.

Feel free to reach out directly my contact details are as follows: Carina Myles on +353 1 293346 or carina.myles@eisneramper.ie

Authors

EisnerAmper Ireland Opens Ireland West Office in Sligo

EisnerAmper Ireland are delighted to announce the establishment of our Ireland West office and welcome a talented group of professionals who have joined us as we establish our presence in Sligo.

Having an office in Sligo provides us with a greater opportunity to connect with our clients based outside the capital. Sligo also offers a unique blend of professional opportunity and quality of life, making it an ideal location for our expansion, offering staff an alternative location to our Dublin office.

While our permanent Sligo office is currently under development on Stephen Street our team will be located on the campus of Atlantic Technological University. As a hub of talent attraction, education, and retention, the ATU is a welcoming home for our team. This expansion allows us to continue developing exceptional practitioners equipped with the tools capable of delivering the highest quality outcome to our clients.

Our presence in Sligo marks an exciting step in EisnerAmper Ireland’s journey and reflects our focus on investing in people, regions, and the future of professional services in Ireland.

We look forward to becoming an active part of the Sligo business and academic community.

Latest News →EisnerAmper Ireland Welcomes Their 2025 Graduate Trainees

We are delighted to welcome the newest members of our team as part of the EisnerAmper Ireland Graduate Programme 2025.

Our new trainees completed a comprehensive two-week on-site Induction Programme, covering technical training, practical on-the-job experience, and soft skills development. They also gained exposure to our Audit, Accounting & Compliance, and Tax departments.

The EisnerAmper Ireland Graduate Programme is different – from day one, our trainees work alongside Partners and senior management, gaining hands-on experience and building the knowledge, skills, and confidence to develop as a practitioner.

If you are looking to start your career in audit, accountancy, or tax with real-world experience at a firm that values and nurtures dedication and commitment, our Graduate Programme 2026 could be the perfect fit.

Learn more here: https://eisneramper.ie/graduate-programme-join-our-firm/

Latest News →EisnerAmper Ireland Summer Get-Together 2025

In the closing days of Summer 2025 the EisnerAmper Ireland team came together for our annual Summer Party at the Horse Show House Pub.

It was a fantastic afternoon allowing us to relax, connect, and celebrate together outside the office. Events like these are a great reminder that while we work hard, we also take the time to enjoy shared experiences as a team.

A big thank you to everyone who joined us and helped make the evening such a success! We look forward to many more celebrations ahead!

EisnerAmper Ireland Hosts second Discovery Afternoon for Villanova University

On May 13, we were delighted to welcome the 2025 Maymester students from Villanova University to our second EisnerAmper Ireland Discovery Afternoon, a unique, immersive experience designed to share what it means to be a Professional in Practice.

Tailored specifically for students considering careers in accounting, advisory and consulting, the afternoon offered a deep dive into our Firm’s values, culture, structure, and strategic approach. Most importantly, it gave students the opportunity to hear from professionals at all stages of their careers, from trainee to CEO.

Our guests were welcomed by Attracta van Rensburg, CEO of EisnerAmper Ireland, who opened the afternoon by outlining the purpose of the session: to provide meaningful insights into the world of professional services, to demonstrate our people-first approach to development, and to highlight how innovation, design thinking and technology are at the heart of our client service delivery.

Understanding EisnerAmper Ireland’s DNA

Frank Keane, Partner Risk & Regulatory and Board Member of EisnerAmper Global, gave an overview of EisnerAmper Ireland’s position within the EisnerAmper Global network. He walked students through our Firm’s journey, from our beginnings in 2005 as MKO Partners, to the launch of EisnerAmper Global in 2015, to our strategic evolution from a traditional service-based offering to a combined services and solutions model with a niche market focus.

Frank also shared personal reflections on professionalism, ethics, and purpose in practice, sparking conversations on what it means to be a values-driven professional in today’s dynamic and regulated business environment.

People & Pathways: From Graduate to Practitioner

Our HR team, Laura Cowman, Director and Jen Higgins, Manager, introduced students to our Graduate Programme, providing a practical overview of training, career pathways, and the support available to new joiners.

This was followed by an authentic and relatable session featuring Alex O’Meara, a current Intern, and Leanne Mulderrig, a Supervisor. Both shared their personal journeys with EisnerAmper Ireland, from the learning curve of starting out to stepping into leadership and mentorship roles, giving students a real sense of what life is like inside a high-performing, people-focused firm.

Innovation in Action: EA Solve

Students were then introduced to EA Solve, our dedicated solutions division. Joseph Halligan, Manager, and Johnatan Epure, Solutions Builder, led an engaging session on how EA Solve delivers value across a wide range of industries by combining subject matter expertise, cutting-edge technology, and a dynamic, agile approach to problem-solving.

They provided an overview of EA Solve’s innovative operating model, outlining how we approach product development and delivery, from identifying client needs to creating scalable solutions that drive results. To bring this to life, students were given a live demonstration of CU Risk Core, a bespoke risk management system developed specifically for Risk Officers in Irish Credit Unions.

Far from simply responding to change, EA Solve is designed to set the pace, helping clients productise services, solve complex challenges, and operate more efficiently. The session illustrated how innovation at EisnerAmper Ireland isn’t just a concept, but a core strategy embedded in how we think, build, and deliver lasting impact.

ESG & the Future of Reporting

Later in the afternoon, Frank returned to lead a session on Sustainability and ESG Reporting, with a particular focus on developments in the European Union, such as the Corporate Sustainability Reporting Directive (CSRD) and its current iteration.

He explored both the complexities and opportunities these new regulations and their “voluntary” equivalents present for organisations, from data challenges to investor expectations, and he emphasised the growing importance of ESG as a strategic business driver. The session sparked thoughtful questions from the students, including a debate on the sustainability of artificial intelligence itself, highlighting their curiosity and engagement with contemporary business issues.

Fireside Chat with Troy Lavin, VitHit

The afternoon culminated in a fireside chat between Frank Keane and Troy Lavin, Managing Director of VitHit, one of Ireland’s most successful wellness beverage brands. Troy spoke candidly about the entrepreneurial journey, from branding and product development to navigating global markets and underscored the importance of resilience, innovation, and financial discipline.

We concluded the day with refreshments and informal networking in The Bank on College Green, giving students the opportunity to connect further with our team, ask questions, and reflect on the day’s insights.

We would like to extend a sincere thank you to all our speakers and to the Villanova University students for their energy and curiosity. We’re passionate about helping future professionals discover how they can make a meaningful impact, and we look forward to welcoming the next cohort in 2026!

Learning & Development →EisnerAmper Ireland & IADT Sign MOU

EisnerAmper Ireland and IADT join forces to develop cutting edge master’s programmes to transform the Financial Services, International Finance and Governance and Risk landscape.

The Institute of Art, Design + Technology Dun Laoghaire (IADT) and EisnerAmper Ireland announce the signing of a Memorandum of Understanding (MOU). This MOU will include joint research projects, work placement programmes, industry advisory boards and networking and collaboration events. It will initially focus on the development of a new set of stackable micro credentials, leading to a Master’s programme to include: Financial Services, Strategy and Innovation; International Finance & Sustainable Finance and Financial Services, Governance and Risk.

This MOU will leverage the expertise and unique strengths of both partners to create exciting opportunities for future industry-academic endeavors.

Attracta van Rensburg, CEO EisnerAmper Ireland commented

“IADT is a leader in its field, shaping the innovators of tomorrow. We are very proud of our 20 year+ partnership with IADT and are excited to build on that partnership through the signing of this memo of understanding. Supporting IADT is an investment in the next generation of thinkers, creators, and leaders.

Design thinking is in our DNA and which reflects our commitment to creating meaningful connections between the business and creative worlds. We believe innovation happens when creativity meets commercial thinking. This collaboration with IADT brings those forces together brilliantly.”

Long-time collaborator with IADT, Frank Keane, Partner, EisnerAmper Ireland, added

“The signing of this MOU marks a new chapter in our Firm’s relationship with the Institute. I’m really looking forward to working with faculty, colleagues and clients on this next generation of programmes. I firmly believe we get a better outcome when we take a multidisciplinary and cross-industry approach to course design. When you do, the solutions to solving our most challenging issues come with more ease.”

The signing of the MOU accentuates IADT’s and EisnerAmper Ireland’s dedication to advancing-driven solutions in the financial industry. The focus is on delivering high-quality stackable programmes at Masters level combining EisnerAmper Ireland’s industry expertise with IADT’s practice-led expertise in the creative and technological sectors promises to be a powerful force.

TU RISE is co-financed by the Government of Ireland and the European Union through the ERDF Southern, Eastern & Midland Regional Programme 2021- 27.

EisnerAmper Ireland is a specialist firm of accounting, tax, Ireland & UK audit, advisory and risk & regulatory experts. It has a niche focus on the Financial Services and International Trade markets. EisnerAmper Ireland is a founding member of EisnerAmper Global, a specialist network of independent member firms operating via global international trading and financial services hubs. Being part of EisnerAmper Global gives clients access to the experience and expertise of EisnerAmper’s 450 Partners and 4,000 professionals across the United States and key trading hubs globally.

IADT is a leader in higher education with a specialist focus on the development of future makers, shapers, technologists, thinkers, storytellers and creators who lead and innovate in a changing digital world. Explore what’s on offer and start your IADT future today.

Learning & Development →Reflections from CUMA 2025: Balancing Growth & Governance

Ireland’s credit unions are at a turning point, evolving from simpler savings and loans institutions into fully-fledged financial service providers. With recent regulatory changes, it is clear that the government sees them becoming our “community banks” – offering personal loans, mortgages, business loans, current accounts and insurance. However, this transition is in its early stages, with credit unions still understanding how to adapt their business models to sustain long-term growth.

With the sector on the threshold of significant transformation, this year’s CUMA Conference 2025 presented the perfect opportunity to ask questions, share experiences and voice challenges.

The expanding role of credit unions means maximising opportunity while minimising risk.

A key sentiment emerging from CUMA 2025 was that a cautious, strategic approach will be crucial for steady and sustainable growth. While there is significant potential for credit unions to do more for their members, careful liquidity management, regulatory compliance and operational resilience are essential.

As the Deputy Governor of the Central Bank, Sharon Donnery recently stated:

“It is not often you hear a regulator asking a sector to grow its loan book – to say that we are changing the rules to enable you to do more. So, you won’t be surprised to hear me say that with opportunities come responsibilities.

And so, while the sector continues to mature its offerings – it must also continue to mature its risk management and governance.”

The past ten years have been transformative for Irish credit unions. The number of institutions has halved, while the number of large Credit Unions has more than doubled. Average reserves now stand at 16.5%, well above the statutory minimum of 10%. There is an accelerated lending trajectory with substantial growth in loan portfolios – total loans have grown by 73% in the last ten years – and half of this growth has occurred in just the past two years. More financial products are now available than ever before: mortgages, business loans, current accounts – and with an average loan-to-asset ratio at circa 33%, credit unions still have significant capacity to expand lending activity.

However, while recent times have been a time of growth, there must also be an acknowledgement of the risks involved and the past mistakes of the financial sector, as well as a general acknowledgement of the limitations of credit unions – the model, the liquidity and the funding mechanisms that they can access, in comparison to banks.

As Dean Roche, Head of Finance at Ireland’s largest credit union, St Raphael’s Garda Credit Union, made clear in his remarks, caution is the dominant sentiment, even among the most capable institutions. St Raphael’s would not be approaching the proposed 30% mortgage lending limit set out in CP 159 anytime soon, opting for steady and sustainable growth instead and running their business to ensure it continues to be both financially and operationally resilient.

As credit unions evolve, so must their governance and risk management structures.

Recent legislative and regulatory proposals will create substantial opportunities for credit unions to expand their business models responsibly.

The Credit Union (Amendment) Act 2023 facilitates enhanced collaboration between credit unions and paves the way for corporate credit unions. CP 159 proposes the decoupling of lending limits, with separate concentration caps for house lending (30% of total assets) and business lending (10% of total assets). It also provides for the removal of asset-tiering restrictions, allowing all credit unions to operate within the same concentration limits regardless of size.

With retail deposits as a relatively stable funding source, credit unions could become an effective player in the Irish mortgage market. However, achieving all this requires a fundamental shift in risk culture and Asset and Liability Management (ALM).

Donal Corbett, CEO of Lumon FX, Europe reminded us in his opening remarks that “Markets can remain irrational longer than you can remain solvent.” He took us back to 2008, when a credit crisis led to a liquidity squeeze which led to a credit crunch.

Historically, banks focused on capital but underestimated liquidity risk—leading to stark regulatory changes post-crisis. Credit unions currently lack advanced funding tools such as short-term repo arrangements and access to ECB funding, medium term note programmes and long-term securitisations, and their ALM frameworks are still being developed. This means their ALM practices must mature before they embark upon a journey towards significant long term lending expansion.

Credit unions can also consider proactively adopting best practices from the banking sector using for example tools similar to the banking liquidity ratios. It is also vital that credit unions continue to closely monitor their savings on a forward-looking basis, as well as their lending and investment strategies, to mitigate maturity mismatches.

And for smaller credit unions, they should be undertaking significant readiness assessment work before they consider entering new product lines such as mortgages and business loans.

For effective asset and liability management, learn what good looks like.

In this new territory, understanding “what good looks like” is more crucial than ever. Dean Roche offered some key insights into how St Raphael’s has maintained stability and growth.

With ten consecutive years of loan book expansion and a robust Asset Liability Management (ALM) framework, St Raphael’s welcome CP 159 as a progressive step. The key to their risk strategy? Vigilant liquidity management. They work to ensure that lending growth doesn’t outpace the predictability of members’ savings.

Dean emphasised that sustaining loan book growth depends on several factors, including the retention of existing shares, new deposits, and the maturity timing of investments. This approach centres on discipline: liquidity positions are assessed daily, weekly, and monthly to maintain financial resilience.

Dean believes St Raphael’s is an attractive mortgage provider due to its trusted reputation, stability, personalised service, and not-for-profit model and he presented St Raphael’s approach for navigating these uncertain waters.

His advice? Keep pricing structures simple, remain vigilant about member share trends, define a clear risk appetite and enhance ALM frameworks. Stress testing is also vital in preparing for any potential volatility.

Embracing digitalisation is crucial to compete in a changing financial landscape – but it brings a fresh challenge.

Another key topic discussed at the conference was the generational shift in expectations that credit unions are now facing. With 86% of Irish consumers using mobile banking, consumer behaviours are changing, and credit unions must adapt to this new environment. Many credit unions have embraced mobile apps and online banking, but the changing demographic of credit union members presents a challenge for the future of the loan book.

Traditionally, credit union savings have been “sticky”, but digitisation and SEPA instant payments are making it easier to move your money. This poses a risk to the future stability of credit unions’ funding sources. Funds that once remained within the credit union ecosystem can now be transferred instantly to digital banks. Credit unions can no longer assume that retail savings will be as “sticky” in the future as they are now.

Times are changing but credit unions must protect their unique position in the community.

In all discussions, it was widely recognised that a major strength of credit unions remains their member-first approach. They have always prioritised member welfare, particularly during times of financial hardship like COVID. This presents a unique challenge as credit unions expand their long-term lending capabilities. They must develop their risk management, operational resilience and financial resilience frameworks.

Despite the challenges ahead, there is real optimism for credit unions’ future. The sector has the capacity to grow— safely and steadily — with improved governance, investment strategies and a forward-thinking approach to Asset & Liability Management. It is vital that this is done properly so they can retain their position as Ireland’s most trusted, community-driven financial institutions.

Contact EisnerAmper Ireland

Contact Diarmaid O’Keeffe, Partner, Head of Audit & Advisory, to discuss how to align your strategy with industry changes.

Authors

Reflections on the Irish Funds US Seminar and Ireland’s Strengths as a Private Funds Domicile

As St. Patrick’s Day approached, I had the pleasure of attending the annual Irish Funds US Seminars, in Greenwich, Connecticut, before moving to New York. These events brought together financial leaders and innovators from all over the North American and Irish investment funds space, and I was honoured to be asked to participate in the final panel of the New York event. Accompanying me on this trip were my colleagues David Carroll, Partner, Head of Capital Markets, and Charys Magpayo, Senior Manager, Audit, enhancing our collective experience with their insights, expertise and company.

Nicholas Blake-Knox, Chairperson of Irish Funds, inaugurated the events by highlighting the deep-rooted historical ties between Ireland and Greenwich. He went on to emphasise the significant contribution to Ireland’s funds and asset management industry from US fund managers, who account for a full 33% of assets in Ireland’s Assets under Management (AuM). He pointed out key advancements, such as collaborations with the Central Bank of Ireland regarding strategies for private assets and improvements in Ireland’s capabilities within the private markets.

Amid an atmosphere imbued with characteristic optimism and can-do spirit, the seminars provided a dynamic platform for asset management leaders to engage in rich dialogue and share actionable insights. These gatherings helped both seasoned experts and new players alike forge paths for future development. Both legs of the event were well attended, showcasing Ireland and its role in the international fund management arena.

At the seminar’s closing act in New York, I moderated “The Private Funds Toolkit – Launching from Ireland” before 200 industry leaders, joined by Lloyd Collier from JTC Group, Melíosa O’Caoimh of Northern Trust and Scott Parkin of Zeidler Group. Our discussion drew out Ireland’s advantages for private funds: regulatory agility, tax efficiency, global distribution and operational excellence.

IRELAND’S REGULATORY ADVANTAGES: WHERE FLEXIBILITY MEETS FAMILIARITY

My first panel question was to Scott Parkin from Zeidler Group, a specialist funds law firm, about the regulatory advantages of Ireland and the various legal structures available, specifically the Irish Collective Asset-management Vehicle (ICAV) and the Investment Limited Partnership (ILP), and how they fit into the private markets toolkit.

What emerged from the panel, and from some of the prior talks in the Seminar, included:

Regulatory toolkits provide agility: Frameworks like the ICAV and ILP, highlighted by our panel’s experts, offer segmented liability and LP-friendly governance, critical for private equity and credit strategies. This matters because it allows Alternatives Managers to launch operations more quickly and cost-effectively than in other jurisdictions. How much quicker and how much cheaper? It was said at the event that launching in Ireland is up to 40% cheaper on average compared to other European jurisdictions and could be up to 50% faster too.

Common Law Advantage: The foundational strength of common law in Ireland aligns well with US and international business practices, making it a straightforward choice for global investors. The importance of this becomes clear to anyone restructuring a fund mid-stream – they soon appreciate Ireland’s common-law agility! The recent EU pre-marketing reforms, allowing managers to gauge interest before full launches, further tilt the scales, a point appreciated by multiple speakers through the Seminar.

Tax Efficiency as a factor: Ireland’s 0% withholding tax for private credit (via US treaties) emerged as an important benefit, earlier highlighted at the Greenwich Seminar. Ireland’s tax treaty with the US provides a unique gateway for non-US investors in Irish domiciled credit funds. In short, it was noted that Ireland’s tax environment includes no corporate, capital gains, or withholding tax for non-Irish investors, and coupled with an extensive double tax treaty network, it offers an ideal setting for establishing tax-efficient fund structures.

A DIPLOMATIC DANCE

A lively debate ensued when I asked both Lloyd Collier (JTC Group) and Scott Parkin (Zeidler Group) to discuss why they believe Ireland is a preferable domicile compared to other EU jurisdictions. This was tongue-in-cheek, intended to stir some hearty debate from the panel, which it did.

Cost efficiency (40% savings), tax efficiency (no withholding tax), time-zone advantage (5 hours, not 6 hours difference with New York), direct flights to Ireland, and the delegated management model were all cited.

I invited Lloyd to expand and demystify the delegated management model, a cornerstone of Ireland’s appeal for cross-border funds. It was elaborated that this framework, while anchoring funds in Ireland’s robust regulatory regime, allows for a globally dispersed operational ecosystem. This model is particularly relevant as it illustrates how, although funds may be domiciled in Ireland, the operational ecosystem can span multiple jurisdictions, with General Partners (GPs) in one country (for example the United States), Limited Partners (LPs) in another (for example, spread across Europe or Asia) and underlying assets in a third jurisdiction, all managed under an Irish structure that supports this complex arrangement. Such an approach delivers three advantages: jurisdictional flexibility, operation simplicity and investor confidence.

Finally, with my tongue firmly in my cheek once again, I challenged Melíosa to comment on the fact that €2 trillion of the assets under administration in Ireland are actually domiciled in other jurisdictions. Although she remained neutral, noting Northern Trust’s operation across multiple jurisdictions, she did acknowledge the competitive positioning and strength of the ecosystem of Ireland in the global funds industry.

OPERATIONAL AND DISTRIBUTION CAPABILITIES

While Ireland’s regulatory and tax advantages set the stage, discussions at my panel and throughout the US Seminar revealed what truly powers fund success – Ireland’s distribution capabilities. Here’s how Ireland’s delivers:

UCITS (Undertakings for Collective Investment in Transferable Securities): The UCITS brand is recognised not only as a kitemark of quality within the EU but also as a premier vehicle for distributing investments to Asia and Latin America. Its reputation for quality ensures that it is the preferred choice for investors looking to access markets in these regions. The UCITS brand extends far beyond European borders, facilitating global investment flows and showcasing the EU’s influence in international finance.

On the note of global distribution, another panellist, Dirk Grosshans from Universal Investment, said Ireland serves as an ideal hub for global fund distribution, capable of reaching markets in up to 90 countries.

Private Assets AuM Growth: In 2025, Investments in private assets are expected to reach €15 trillion in AUM, up from €10 trillion in 2010. Consensus estimates suggest that by the end of 2027, private capital AUM could reach €18 trillion, a good chunk of which is expected to be domiciled in Ireland.

Pre-marketing Capability: Ireland’s regulatory framework now permits pre-marketing activities, empowering fund managers to assess investor interest and refine their offerings prior to a full-scale launch. This capability is pivotal for strategically positioning new funds in a competitive marketplace, enabling optimal alignment with market and investor expectations. Not long ago, managers weren’t able to really test their hypothesis before launch. That pre-marketing ability has reduced the failure rate for American managers coming into the EU dramatically.

HIGHLIGHTS FROM SPEAKERS AROUND THE EVENT

Beyond my panel discussion, and in conversations with colleagues David Carroll and Charys Magpayo during the seminar, several additional strategic advantages for Ireland emerged:

Innovation and technological advancements as a differentiator: Ireland is a leader in financial technology, utilising proprietary software and platforms that enhance fund management efficiency and investor engagement, supporting activities from Exchange Traded Fund (‘ETF’) wrappers for mutual funds to comprehensive digital asset management solutions.

EU and Irish Jurisdictional Innovations: Jennifer Carroll MacNeill TD, Irish Minister for Health (formerly Minister for Financial Services), speaking in New York, highlighted Ireland’s significant contributions to the U.S. financial services sector and its commitment to innovation, citing private asset funds and sustainable finance as examples.

David highlighted to me an important contextual point also. The EU is actively working to reduce regulatory complexity by 25% by 2029, aiming to streamline operations and enhance market efficiency and accessibility. Additionally, the EU’s new Savings and Investment Union plans to mobilise roughly €9 trillion in retail bank accounts across Europe to stimulate investment and savings, enhancing opportunities to gather assets from a relatively untouched source.

In Ireland, innovation continues with flexible financial products like EFT wrappers for mutual funds, which improve liquidity and tax efficiency. The financial landscape also accommodates a range of operational models from completely independent setups to collaborative approaches with third-party management company umbrellas, ensuring effective fund management across the spectrum.

CONCLUSION

These insightful discussions with my fellow panellists and colleagues showcased to our audience Ireland’s unique advantages as a domicile for private funds, including its robust regulatory environment, strategic geographic positioning and the sophisticated ecosystem it uses to support US fund managers looking to raise assets from the EU – and around the world.

Many thanks to Irish Funds for the opportunity to moderate, to the organisers, and all who made this such a valuable event, David, Charys and I are already looking forward to next year’s Seminar.

Contact Us

If you would like to gain deeper insights into this area and explore how it may impact your business, we invite you to connect with Paul Traynor, Partner and Head of Governance, Risk, and Compliance or Ian Wilson, Partner and Head of Funds.

Authors

- 1

- 2

- 3

- …

- 39

- →Next Page »

-

Ireland

Our European

head office is

located in Dublin.+353 1 293 3400

-

Luxembourg

2, Rue Marie Curie

L-8049 Strassen

Luxembourg -

United States

We have multiple

offices locations across

the United States.+1 212 949 8700

-

Cayman

Our Central American

office is located in

Grand Cayman.+1 345 945 5889

-

Singapore

Our Asia office is located in

Singapore.+65 6305 9900