EisnerAmper hosts Big Brunch in aid of the Irish Hospice Foundation

EisnerAmper was delighted to support Ireland in their match against Russia in the Japan Rugby World Cup this morning in the EAI office in aid of the Irish Hospice Foundation.

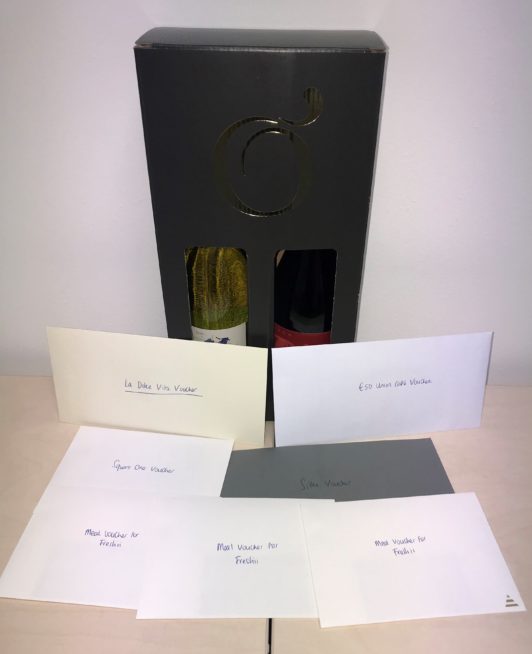

Staff enjoyed brunch during the match catered by The Food Crew Sandyford. At the end of the game a raffle was held and prizes included very kind donations from the local business community including, Union Café, La Dolce Vita, Sqaure One, Freshii, Silke Hair and Beauty and O’Briens Wines. We are proud to donate over €800 from the match viewing and raffle to the Irish Hospice Foundation.

The Irish Hospice Foundation strives for the best care at end of life for people and practical support for their loved ones. The foundation provides nurses for night care, hospice home care for children and palliative care for all, including many other facilities. The Irish Hospice Foundation is the only national organisation dedicated to dying, death and bereavement in Ireland. With state funding being less than 8% of their total income in 2017, the hospice relies on the public to fund the majority of their work. To read more about the foundation click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper participates in Sandyford 5k Run 2019

EisnerAmper Ireland is proud to have been a participant in the 2019 Sandyford 5k Run, which took place on Thursday 26 September. The event is hosted by Dundrum South Dublin Athletic Club (DSDAC), in association with the Sandyford Business District and caters for walkers, joggers, fun runners and athletes.

From L to R back: Brian Frawley, Claude Makiesse, Jonathon Squire, Cian Collins, Warren Bridge & Tony Keegan. From to L to R front: Aideen Conneely & Sarah Ryan

The event attracted it’s largest number of participants this year since its first race in 2015. The race is organised to raise funds for the exciting new Sports Campus for the DSDAC. It was a fantastic opportunity to get a team together within the Firm and meet local business people in the community. To learn more about the Sandyford 5k Run, click here.

We care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →Meet the Team!

Meet the Team! This month we welcomed 15 new joiners to the EisnerAmper Ireland office. Our new joiners will be working in the Financial Services, Tax and International Business Departments.

Our new colleagues have completed a two week induction programme, covering various topics ranging from technical, on the job and soft skills training, delivered by our HR Team.

To learn more about our staff, including our new joiners, click here.

From L to R: Dylan O’Neill, Jass Teh & Diana Ciubotariu

From L to R: David Molloy, Pearse OBrien, Robert Beverland, Sean Goodburn & Jennifer Thompson

L to R: Celina Dunne, Emma Hodgins, Agne Valinskyte & Hugh Kelly

We care about business and we care about the people we work with in business.

Our team includes people with multi-disciplinary backgrounds who bring fresh, candid and connected perspective to how we work. We strive to nurture and leverage the talent and unique ability of each individual member of our team. To read more about Life in EisnerAmper and about our career opportunities click here.

Contact Us

Latest News →VAT On Food Supplements

General VAT Treatment Of Food

The VAT treatment of food and drink in Ireland can vary depending on what is being sold and how it is being supplied to the customer. The majority of food sold in shops and supermarkets is at zero rate, while the reduced rate (13.5%) applies to certain baked items including crackers, bagels, cakes and plain biscuits, and the standard rate (23%) applies to various items, examples of which include ice-cream, chocolate biscuits, sweets and crisps. Hot food and food provided in the course of catering is liable to VAT at the reduced rate while food supplements are treated separately for VAT purposes.

More information on the VAT treatment of food can be found on the Revenue website here.

What Are Considered Food Supplements For VAT Purposes?

For VAT purposes, food supplements are items for human consumption which are not ordinarily considered to be food and which are marketed to the consumer as dietary supplements.

VAT On Food Supplements – Current Issues

As these items are not considered food they are subject to VAT at the standard rate, however, in 2011 Revenue issued guidance (eBrief No. 70/11) to the effect that vitamins and minerals, in either tablet or liquid form, and fish oils for human consumption are subject to zero rate VAT.

VAT On Food Supplements – Upcoming Change

In December 2018, Revenue issued new guidance which confirmed the removal of the zero rate concession for vitamins, minerals and fish oils. As of January 2020, these items will be subject to the standard rate of VAT. Revenue also confirmed that as well as food supplements such as those defined above, the standard rate of VAT also applies to sports nutrition supplements, slimming aids, and liniments, ointments and rubs made from food ingredients.

Source: revenue.ie.

VAT On Food Supplements – Potential Impact of Upcoming Change?

With the vitamin and mineral market in Ireland currently worth circa €37 million annually (source: Statista), the overall increased cost of the new VAT measures to the Irish consumer will be approximately €8.5 million per year. This figure is set to rise, as the Irish vitamin and mineral market has an expected compound annual growth rate of 1%.

How EisnerAmper Ireland Can Help

At EisnerAmper Ireland, our dedicated team of Tax professionals possess the knowledge and experience required to provide technical guidance and specialist advice on this and all other VAT and Indirect Tax related matters. We tailor our offering to your needs, ensuring you receive the best advice at the appropriate time.

Learn more about our outsourced Tax Services here.

Request a Callback

Request a Callback from our Tax specialists now.

Latest News →Insurance Ireland INED Forum supported by EisnerAmper

On Thursday, 19 September, Insurance Ireland, supported by EisnerAmper Ireland, hosted the latest in the INED Forum series in the St. Stephens Green Club, Dublin. The event was a great success and we were delighted to have the opportunity for members of our team to connect with the Insurance & Reinsurance INED community.

Dave Montgomery, Partner and Head of Risk & Regulatory at EisnerAmper Ireland moderated the event. The keynote speakers were Domhnall Cullinan, Director of Insurance Supervision at Central Bank of Ireland and Brendan McCarthy, a key member of the INED community and new Vice Chair of the Insurance Ireland INED Council.

(L to R): Brendan McCarthy, Domhnall Cullinan and Dave Montgomery

EisnerAmper Ireland is delighted to continue working with Insurance Ireland and their INED Council. As the voice of insurance actively promoting the highest standards, Insurance Ireland represents 95% of the domestic market and more than 80% of Ireland’s international life insurance market. The Insurance Ireland INED Council promotes best practice for insurance industry INEDs in addition to acting as a sounding board for entities, organising appropriate training and acting as a networking hub.

(L to R): Domhnall Cullinan and Vincent Sheridan

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

EisnerAmper Ireland is a firm of specialist accountants with a niche focus on the Financial Services, International Trade and Government sectors. As Head of Risk & Regulatory at EisnerAmper Ireland, Dave Montgomery leads a team in the provision of regulatory, risk management, audit and advisory solutions to Insurers and Reinsurers operating in or through Ireland. As a former regulator with the Central Bank of Ireland, Dave supervised insurance and reinsurance firms and also worked on the development and implementation of the PRISMTM framework. If we can assist you or your business in any way, please contact Dave Montgomery.

Contact Dave

Latest News →EisnerAmper Ireland attends launch of partnership between Chartered Accountants Ireland and leading software providers

Minister for Finance, Public Expenditure & Reform, Paschal Donohoe, TD with student Sarah Ryan of EisnerAmper and Supreeth Mohan of HLB Ryan. Back row (l-e): John Munnelly, Chartered Accountants Ireland; Ian Browne, Chartered Accountants Ireland; Conall O’Halloran President of Chartered Accountants Ireland; Eugene Hillery of Tableau and Michael Ellis of UiPath.

On 16 September, Sarah Ryan, Trainee Chartered Accountant at EisnerAmper Ireland, attended the launch of a new partnership between Chartered Accountants Ireland and leading software providers UiPath, Tableau and Alteryx. From the end of September 2019, more than 1,300 students per year will begin to study and develop practical skills in Artificial Intelligence (AI), Robotic Process Automation (RPA), Data preparation and Data analytics, Blockchain and Cryptocurrencies as part of a shake-up of the Institute’s education programme for final year students.

Attending the launch, the Minister for Finance, Public Expenditure & Reform, Paschal Donohoe, TD, welcomed the partnership noting, “Ireland has the potential to be a global leader and location for innovation in financial and technology services. I welcome the collaboration between Chartered Accountants Ireland and UiPath, Tableau and Alteryx to meet the evolving needs of Ireland’s financial services sector. This programme will ensure that as technology shapes the sector over time, Ireland will continue to have a talent pool of people skilled and available to business and industry.”

Sarah Ryan was delighted to represent EisnerAmper Ireland at the launch event and to meet with Minister Donohue, President of Chartered Accountants Ireland, Conall O’Halloran, and representatives from UiPath, Tableau and Alteryx.

The partnership will create new highly skilled graduates ready to fill in-demand roles in industry and private practice, many of which did not exist five years ago as firms increase their own investment in new technologies to service client work with greater efficiency, accuracy and insight. Currently, 70% of the Institute’s graduates already work in the industry as in-house advisors to some of Ireland’s largest technology, finance, aviation and energy companies.

At EisnerAmper, we design and deliver business & compliance solutions to make trade happen.

Domestic and international businesses face significant regulatory, economic and financial challenges while the rise of FinTech, RegTech and other solutions present new opportunities. Successfully managing these challenges, while optimising opportunities, requires specialist expertise and innovative solutions. We combine our subject matter expertise with best in class technology platforms to deliver market leading solutions to the financial, regulatory and professional services sectors. If we can help you or your business in this regard, contact us.

Contact Us

Latest News →EisnerAmper Ireland attends Les Rendez-Vous de Septembre in Monte Carlo

Dave Montgomery and Tom Brennan, Risk & Regulatory Partners at EisnerAmper Ireland, attended one of the biggest events in the insurance calendar, Les Rendez-Vous de Septembre in Monte Carlo. The event was a great success and we were delighted to have the opportunity for members of our team to meet clients and connect with friends of the Firm.

Lez Rendez-Vous de Septembre is an international Reinsurance congress that facilitates participants meeting to discuss matters which concern the market. It also marks the beginning of the annual negotiation process prior to the renewal of Reinsurance treaties, encouraging high level contact and engagement which can lead to long term strategic alliances.

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

EisnerAmper Ireland is a firm of specialist accountants with a niche focus on the Financial Services, International Trade and Government sectors. As Head of Risk & Regulatory at EisnerAmper Ireland, Dave Montgomery leads a team in the provision of regulatory, risk management, audit and advisory solutions to Insurers and Reinsurers operating in or through Ireland. As a former regulator with the Central Bank of Ireland, Dave supervised insurance and reinsurance firms and also worked on the development and implementation of the PRISMTM framework. If we can assist you or your business in any way, please contact Dave Montgomery.

Contact Dave

Latest News →EisnerAmper Ireland attends basis.point 7th Annual Corporate Golf Challenge

EisnerAmper Ireland are proud supporters of basis.point, the Irish Fund Industry’s initiative to come together to help make a difference to those in need.

On Friday 6 September, Gavin Lee, Head of International Trade, David Carroll, Director, Financial Services, and Cian Collins, Senior Manager, Financial Services, were invited to the basis.point 7th Annual Corporate Challenge in Milltown Golf Club by Link Asset Services. The event was a great success and we were delighted to have the opportunity for members of our team to enjoy a pleasant afternoon and connect with friends of the Firm.

basis.point’s vision is to help make a sustainable and tangible difference to the lives of those living in poverty, particularly young people, by supporting charities which focus on education.

To find out more about basis.point or to donate, visit basispoint.ie.

We care about business and we care about the people we work with in business.

At EisnerAmper Ireland we create business & compliance solutions for Asset Managers and Funds to make trade happen. If we can assist you or your business in this regard, please contact Gavin Lee.

Contact Gavin Lee

Latest News →EisnerAmper Ireland Summer Games 2019

On Friday 30 August 2019, EisnerAmper Ireland’s staff took part in our Summer Games and BBQ in Wanderer’s Rugby Club, Dublin 4.

The EisnerAmper Ireland team enjoyed an afternoon of sports and activities, including archery and a slow bike race, followed by a BBQ and drinks at the venue. The evening was a great success and provided an opportunity for newer members of the team to get to know the rest of the Firm, while all employees enjoyed a break and an afternoon in the fresh air.

Members of Team 4 won the first place prize at the Summer Games and were awarded medals and gift tokens from the Firm. The winning team, pictured above, consisted of Ciaran Brady, Jennifer Thompson, Aisling Power, Gavin Redmond and Thomas Territt.

A selection of photographs from the event can be found below.

( L to R back: Alastair MacDonald, Shane Mooney, Brian O’Callaghan, Zoe Maloney, Kun Liu) (L to R front: Aidan Lundy, David Bell)

(L to R back: Jennifer Kelly, Yevgeniy Podkladnev, Stephen Murtagh, Aideen Conneely, Celina Dunne) (L to R: front: Jarlath Glynn, Malin Wallvik)

(L to R: James Farrelly, Aisling McCaffrey, Gavin Lee, Jass Ern Teh, Doru Florea, Cian Collins, Matthew McCarthy)

We care about business and we care about the people we work with in business.

Our team includes people with multi-disciplinary backgrounds who bring fresh, candid and connected perspective to how we work. We strive to nurture and leverage the talent and unique ability of each individual member of our team. To read more about Life in EisnerAmper and about our career opportunities click here.

Latest News →Dave Montgomery presents at The Association of Compliance Officers in Ireland Seminar 2019

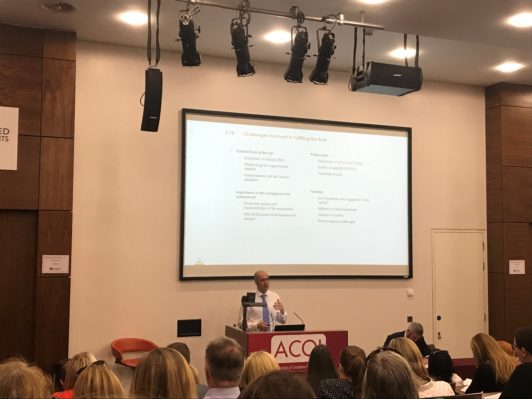

On Wednesday 28 August 2019, Dave Montgomery, Partner and Head of Risk & Regulatory, presented at the Chartered Accountants House, Pearse Street, for it’s latest Association of Compliance Officers in Ireland (ACOI), lunchtime seminar.

The event was a great success and we were delighted to have the opportunity to present to members of the ACOI community. Dave covered a range of topics at the seminar including the role of the Compliance function, regulatory expectations regarding how they should operate and how sectoral differences may impact on those working in compliance roles among other topics.

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

EisnerAmper Ireland is a firm of specialist accountants with a niche focus on the Financial Services, International Trade and Government sectors. As Head of Risk & Regulatory at EisnerAmper Ireland, Dave Montgomery leads a team in the provision of regulatory, risk management, audit and advisory solutions to Insurers and Reinsurers operating in or through Ireland. As a former regulator with the Central Bank of Ireland, Dave supervised insurance and reinsurance firms and also worked on the development and implementation of the PRISMTM framework. If we can assist you or your business in any way, please contact Dave Montgomery.

Contact Dave

Latest News →EisnerAmper Ireland hosts Annual Golf Day 2019

On Thursday 22 August 2019, EisnerAmper Ireland hosted its Annual Golf Day in Powerscourt Golf Club, Enniskerry. Thank you to all the participants who took part on the day.

The event was a great success and we were delighted to have the opportunity for members of our team to connect with so many clients and friends of our Firm. A total of 18 teams enjoyed a light lunch before heading out to the East Course for a very enjoyable afternoon of golf.

The game was followed by refreshments and a BBQ on the balcony of the Clubhouse with prizes presented to the winning teams.

Please see below for a selection of photo’s from the day.

Ray Kelly & Dave Carroll presenting 1st place winners: (L to R: Paul MacCarthy, EAI, Karl McEneff, Sumi Trust & Barry Griffin, Greenlight) their clubs

Ray Kelly presenting 2nd place winners: (L to R: Morgan Sheey, Walkers, Paul Griffith, Intertrust, Nigel Woods, Almstrow, Dave Carroll, EAI) their golf shoes

Ray Kelly & Dave Carroll presenting 3rd place winners: (L to R: Hugh O’Hagan, W&W, Donal Courtney, INED, David Whelan, INED, Matthew Williamson, Montlake) their windsheeters

Dave Carroll in action

Team 9 (L to R: Jonathan Webster, Cafico, Gerry Webster, Standard Life, Ruth Patterson, INED & Brian Lehane, Pobal)

Derek Maltby in action

Team 7 (L to R: Ian Duncan, Shane Mooney, Richard Larkin, & Des O’Donohoe, Fund Recs)

Damian McAree in action

Team 1 (L to R: Christian Currivan, INED, Diarmaid O’Keeffe, EAI, Rodney O’Rourke, Cafico & Fergal Moloney, Apex)

Team 14 (L to R: Peter Brophy, INED, Aidan Cassells, Ivernia, Aengus Cummins, INED & Eoin Byrne, Everest)

Team 12 (L to R: Gary Morrissey, Invesco, Des Fullam, Carne, Matthew Tracey, DMS & Brian Groves, Intertrust)

Team 13 (L to R: Declan Farrell, Greenlight, Cian Collins, EAI, Michael Brady, AGF & Jim Kelly, INED)

At EisnerAmper, we design business & compliance solutions to make trade happen.

Domestic and international businesses face significant regulatory, economic and financial challenges while the rise of FinTech, RegTech and other solutions present new opportunities. Successfully managing these challenges, while optimising opportunities, requires specialist expertise and innovative solutions. Should you have any needs in this regard, we’d be happy to assist – please contact Gavin Lee.

Contact Gavin Lee

Latest News →EisnerAmper Ireland’s Blood Donation with the Irish Blood Transfusion Service

On Wednesday 14 August 2019, a number of EisnerAmper Ireland staff members visited the Irish Blood Transfusion Service in their Stillorgan clinic to donate blood. We were delighted to be able to donate and help such an important cause. Staff members were offered a ‘work ferry service‘ between our office and the clinic to attend their donation session, organised by the Stillorgan clinic.

It is vital to donate blood as 1 in 4 people will need a blood transfusion at some stage in their lives and only 3% of the eligible Irish population are currently giving blood. One donation is capable of saving up to three lives and you are able to donate every 3 months.

The shelf life of blood is only 35 days and 3,000 units of blood is needed each week so consider donating blood today, find out if you are eligible here.

EisnerAmper Ireland, we deliver solutions to support our community.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →- ←« Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 38

- →Next Page »