Ireland’s Investment Limited Partnership (ILP): Some Key Messages

By David Naughton, Partner, LK Shields Solicitors LLP & Ian Wilson, Director, EisnerAmper Ireland

Introduction

Ireland’s common law partnership, the Investment Limited Partnership (ILP), which comes into existence when it is authorized by the Central Bank of Ireland (CBI) as a regulated E.U. alternative investment fund (AIF), has recently been revamped and is now available as a partnership structure for use by international sponsors and limited partners (LPs).

In this article, we briefly consider some key messages about the ILP, which can be factored into decision-making about the domicile and structure of an AIF in the form of a partnership.

Some Key Messages

1. The ILP Is A Regulated E.U. AIF

An ILP is an AIF whose legal structure is a common law partnership. An ILP comes into existence when it is authorised by the CBI and is then subject to a supervision regime within the legal and regulatory framework for AIFs in Ireland. An ILP is, first, an AIF and, second, a partnership.

2. International Sponsors and Limited Partners Will Be Familiar With It’s Structure

The ILP is a common law partnership structure, which is a popular choice for structuring private equity and real estate (PE/RE) investment funds. Some key advantages of the ILP include:

2.1 Tax transparency

- An ILP is treated as tax transparent from a tax perspective in Ireland in respect of all its income, gains and losses.

- Any income, gains or losses which arise at the level of an ILP shall under tax rules in Ireland be treated as arising, or, as the case may be, accruing, to each partner of the ILP as if such income, gains or losses had arisen, or, as the case may be, accrued, to the partners without passing through the ILP.

- Therefore, the allocation of income, gains or losses should follow the commercial allocation of profits under the partnership agreement.

- Distributions can be made by an ILP to its partners free of any tax implications in Ireland as all the underlying profits of the ILP have already have been allocated to partners for tax purposes in Ireland.

2.2 Flexibility

- An ILP is not subject to legal risk-spreading obligations, making the ILP extremely useful for single asset investment funds and/or investment funds with very concentrated positions.

- The partnership offers a great deal of organizational flexibility so that the specific requirements of individual investors can be accommodated. The partners can set the rules on matters such as how the profits are shared and how the business is to be conducted.

- Consequently, it is suitable for nearly all investors, by type (tax paying or exempt, such as pension funds) and geographical region.

2.3 Limited liability for LPs

- Limiting liability for LPs is a key reason investors prefer partnerships for structuring PE/RE funds.

- PE/RE investors are typically passive investors with very little control, who are investing in relatively illiquid but high-performing asset classes and do not want to monetarily risk more than that which they have committed to the partnership.

3. The CBI’s New Regulatory Regime Compliments A Closed-Ended ILP

An ILP can be open-ended and may be a suitable structure for certain strategies (for example, a credit strategy). However, an ILP is typically closed-ended as this structure fits in with the typical investment strategy of a PE/RE manager – to invest in, and develop, illiquid assets over the long-term, without having to factor in asset liquidity concerns owing to potential investor redemption requests.

By using a closed-ended structure, the sponsor of an ILP can now harness the CBI’s guidance issued on 2 February 2021 introducing new structuring features, which can give flexibility to a closed-ended ILP, as follows:

3.1 Interests may be issued as a fixed price throughout the life of a closed-ended ILP.

3.2 A closed-ended ILP may facilitate excuse provisions (which enable an LP to be excused from an investment that the ILP proposes to make) and/or exclude provisions (which permit the ILP to exclude an LP from a proposed investment that the ILP intends to make).

3.3 To facilitate new investors in the closed-ended ILP, the general partner (GP) of an ILP may, at a later stage in the life cycle of the ILP, permit new investors to acquire interests in the ILP, thereby facilitating stage investing.

3.4 A closed-ended ILP may establish management interest classes, which permit portfolio managers to participate in investments of the ILP. Such interest classes may participate in the ILP based on conditions which differentiate the interest class from other interest classes in the ILP (for example, to reflect a pre-determined fee arrangement or capital payout which is not pro-rata).

4. The Structure Gives Access To The Valuable AIFMD Marketing Passport

The GP appoints the alternative investment fund manager (AIFM) to the ILP and also acts in an oversight capacity. The CBI requires pre-approval as to the fitness and probity of the directors or partners of the GP before their appointment to its board. A GP is not otherwise authorised by the CBI. In addition, the GP is not required to be located in Ireland nor is there a requirement for a minimum number of directors of the GP to be resident in Ireland.

The AIFM may be authorised in Ireland or authorised in another E.U. member state and allowed to passport its activities into Ireland or authorised outside the E.U.

A key advantage of using an authorised E.U. AIFM is access to the marketing passport, which can permit the sale of ILP interests into the E.U. market. The marketing passport is accessed by filing a notification with the CBI, to include the offering document of the ILP, for each member state of the E.U. within which the E.U. AIFM intends to market the ILP. The CBI will inform the E.U. AIFM when transmission to the relevant host member state competent authority has taken place, which typically takes up to 20 business days, and then the E.U. AIFM can start marketing.

As a result, the ILP is attractive to international sponsors with existing structures in Delaware, Cayman, British Virgin Islands, Guernsey or Jersey looking to access E.U. investors using the AIFMD marketing passport.

An ILP can also be registered for sale globally in accordance with local securities laws, e.g., into U.S. and English markets.

5. The ILP Can Slot Into Various Global Structuring Solutions

This is an important consideration.

Partnership structures are bespoke and there is not a ‘one-size fits all’ approach. In particular, the exact structure used will depend on a number of factors including: (i) the identity of the investors (different investors will have different requirements and sometimes this requires additional parallel or feeder partnerships, with each new partnership requiring a new GP entity); or (ii) the location of the portfolio asset(s).

For example, for U.S. federal income tax purposes, it is possible to “check the box” to treat a vehicle as tax-transparent or tax-opaque. Some U.S. investors (primarily tax-exempt investors) prefer to invest through a tax-opaque structure, while others (primarily U.S. taxable investors) prefer to invest through a tax-transparent structure.

As a result, the ILP can be used where there are two parallel LPs or a master and feeder fund within the same structure to accommodate both types of investor.

6. Flexible Financial Reporting

The ILP legislators ensured that a flexible financial reporting model was made available to support the needs of the ultimate investors.

6.1 Financial reporting frameworks available:

The following financial reporting frameworks available to the ILP are the E.U. International Financial Reporting Standards (IFRS), Financial Reporting Standard 102 (FRS 102) and alternative GAAPs such as U.S., Canada and Japan.

For U.S. managers looking to Europe, it is worth noting that U.S. GAAP has not been approved by every home member state in Europe and to U.S. mangers with Luxembourg-domiciled funds that, on 20 January 2021, the Association of the Luxembourg Fund Industry (ALFI), a representative body of the Luxembourg investment fund community, updated its AIFMD FAQ. It states that Luxembourg AIFMs managing a Luxembourg AIF are required to prepare their financial statements in accordance with the accounting standards of the home member state of the AIF (Luxembourg GAAP and E.U. IFRS). This may now be factor for U.S. managers in considering their partnership’s jurisdiction.

6.2 Umbrella structure

Managers familiar with the Irish Collective Asset-Management Vehicles (ICAV) product will appreciate that the ILP provides similar benefits and flexibility in presentation of the financial statements. ILPs are permitted to have multiple sub-funds, with their assets and liabilities legally ring-fenced, and separate sub-fund managers, thus creating a cost effective product.

7. ILP Authorized As A QIAIF

As noted earlier, the ILP is an AIF which can be authorised by the CBI as either a retail investor alternative investment fund (RIAIF) or a qualifying investor alternative investment fund (QIAIF).

An ILP is not well suited to be authorised as a RIAIF due to the investment and other restrictions attaching to that category of AIF.

On that basis, an ILP is typically authorised as a QIAIF. Owing to the flexibility on investment restrictions, borrowing and related features as well as the speed-to-market, the QIAIF ILP is among one of the more popular structures for PE/RE, private credit, and environmental, social and corporate governance (ESG) investment strategies.

There is huge investor appetite for the QIAIF product, being an internationally recognised brand, with nearly 3,000 QIAIFs (including sub-funds) in the market, accounting for over €750bn in net assets.

On that basis, the decision to be made on structuring a QIAIF in Ireland has been effectively beneficial.

What’s new is that the successful QIAIF can now be housed in a world-class partnership structure, the ILP, which is very familiar to international sponsors and potential LPs as it is a common law partnership based in the EU.

Conclusion

Common law partnerships are the most popular form of investment vehicles globally for PE/RE investment strategies and are very familiar to international sponsors and LPs. The first ILP under the revamped regime, sponsored by a U.S. manager, was authorised by the CBI during March 2021. We anticipate that the stellar success of the QIAIF product to date can be further strengthened by international sponsors housing new QIAIFs in the ILP, primarily to meet the huge investor demand for exposure to illiquid asset classes.

How EisnerAmper Ireland Can Help

At EisnerAmper Ireland, we design and deliver business & compliance solutions to make trade happen. This is what we do every day.

EisnerAmper Ireland is a Firm of specialist accountants, tax advisors and risk & regulatory experts playing a key role in bringing international trade to Ireland and advising Irish corporates. If we can help you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

Authors

The content above is provided for general information purposes only and is not intended to provide, nor does it constitute, professional advice on any particular matter. If you would like more information or would like to discuss any of the topics raised above, please contact the author(s).

Brian Hillery joins the Fifty Faces Podcast as guest speaker

Brian Hillery, Partner and Head of Coaching at EisnerAmper Ireland, was delighted to join Aoifinn Devitt on the Fifty Faces Breakout Room Podcast in collaboration with GAIN – Girls Are Investors on building self-confidence in a changing world.

Brian joined Aoifinn and fellow panellists Executive Coach, Kathryn Heslin, and Executive Search Expert, Kate Grussing to discuss a popular narrative that women are less confident than men and whether this is borne out in the data. Their discussion reveals that lack of self-confidence can be an issue for both women and men at every level in their professions and that it can ebb and flow throughout our careers.

Brian and Kathryn, as Executive Coaches, discuss what having self-confidence really means, how it relates to the stories we tell ourselves, and how developing action plans and reframing events can help to build it. Kate shares how lack of self- confidence manifests at the job search stage, how different candidates can have different assessments of their own competence and how searching for case studies of achievements can be empowering in shaping an employment profile.

The panellists also discuss the benefits of building support circles and identifying mentors in advance of career moves or important milestones in addition to actions listeners can take in their daily lives in order to boost their confidence.

The Fifty Faces Podcast series is hosted by Aoifinn Devitt, Head of Investment – Ireland at Federated Hermes International, and showcases the diversity and richness of the investment world through showcasing inspiring investors and their stories.

The podcast is available on Spotify and Podomatic – please see links below:

How EisnerAmper Ireland Can Help

Over the past 18 months, EisnerAmper Ireland has been creating and embedding a world-class coaching culture across the Firm to help optimise individual and team performance. As Head of Coaching, Brian Hillery designs and delivers bespoke Leadership Coaching Programmes for the Firm’s emerging leaders and also regularly delivers coaching skills sessions across the Firm. For more information on Executive & Leadership Coaching at EisnerAmper Ireland, please contact Brian Hillery.

Contact Brian

Latest News →EisnerAmper joins LauraLynn for 100k in May fundraiser

EisnerAmper Ireland’s CSR Committee is delighted to be participating in LauraLynn’s 100K in May charity fundraiser.

The charity initiative is running from 1st – 31st May and our staff members have been set the task of completing 100km over the 31 days by either walking, jogging or running. EisnerAmper Ireland has set the goal of raising €2,500 for LauraLynn during the 100K in May fundraiser. This is a fun fitness challenge that will bring us together to improve our health and wellbeing, while raising funds for LauraLynn.

EisnerAmper Ireland partnered with LauraLynn Children’s Hospice for the second year running, helping them to support children with life-limiting conditions to live as fulfilling lives as possible and receive the very best care at the end of life. LauraLynn is Ireland’s only Children’s Hospice providing palliative care and support for children with life-limiting conditions and their families.

EisnerAmper has set up a fundraising page if you would like to donate here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper supports Insurance Ireland INED Forum

EisnerAmper Ireland, in conjunction with Insurance Ireland, was delighted to host the second INED Forum of 2021 this afternoon.

The webinar focused on ‘Business Culture and the impact of the Leadership Shadow’. Frank Keane, Partner and Head of Client Internationalisation at EisnerAmper Ireland, moderated the event. We would like to thank Jacqueline Thornton, Manager of EU and Domestic & Regulatory Affairs and Company Secretary at Insurance Ireland for setting the scene, and our panellists for their insightful contributions:

- Paul Harwood – CFO, Holloway Friendly; provided an overview of the culture assessment model he developed and implemented in his own firm and the impact and results he has witnessed; and

- Claire Lanigan – Chief Risk Officer, Wells Fargo; shared her experience of working with the Dutch Central Bank in the area of Culture and her successful management of the Behaviour and Culture Review of the Irish Retail Banks in 2018 on behalf of the Central Bank of Ireland.

Many thanks also to the participants who joined today’s webinar and who contributed to our very interesting Q&A session.

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

At EisnerAmper, we design and deliver specialist Services and Solutions for Business in the areas of Governance, Risk and Compliance. In this regard, if we can assist you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

Latest News →New Appointments at EisnerAmper Ireland

We are delighted to announce the expansion of our leadership team with the appointments of Liz Cahill as Partner and Head of Tax and Cian Collins as Associate Partner in our Audit and Governance Risk & Compliance departments.

These appointments represent a further strengthening of our teams advising the Financial Services, International Business and Government sectors while adding significant experience, expertise, ideas and perspectives to our Partner group and team of specialist accountants, tax advisors and risk & regulatory experts.

Liz Cahill, Partner – Head of Tax

As Partner and Head of Tax, Liz leads the provision of the Firm’s tax services and solutions to domestic and international business clients. Liz leads our specialist team of Tax Advisors advising on all taxes including Corporation Tax, Income Tax, VAT, RCT, Payroll, CGT and CAT.

Liz has over 20 years of experience advising a diverse range of Irish and internationally owned businesses and their shareholders in respect of corporate and personal Irish taxation matters. This experience includes advising clients who are setting up and operating in Europe using Ireland as a base.

Liz has significant experience in many areas of taxation including corporate reorganisations, corporate acquisitions and sales, income tax planning, employment remuneration, succession planning, inheritance/gift tax planning, VAT on property transactions and supporting clients with Revenue audits, investigations and enquiries.

Liz joins us from a Big 4 firm having previously worked for a top 10 practice. Liz was a Tax Manager at EisnerAmper Ireland (then MKO Partners) between 2004 and 2007 – we’re delighted to welcome Liz back to the Firm. Liz is looking forward to working with Brian Frawley, Head of International Tax Services, and the Tax team, and to continuing to build on their successes and achievements.

Cian Collins, Associate Partner – Audit and Governance, Risk & Compliance

As Associate Partner, Cian provides Audit and Internal Audit services to Irish corporates and international clients. Cian has extensive experience leading engagements for clients reporting under Irish GAAP, IFRS and US GAAP across the FS sectors (Asset Management, Aircraft Leasing, Structured Finance and (Re)Insurance) and non-FS sectors (Data Solutions, Cybersecurity, Medtech & Healthcare). Cian also provides Internal Audit services to a range of regulated entities.

Prior to joining EisnerAmper Ireland, Cian was a member of the Financial Services Assurance Group of a Big 4 Firm working in Dublin and New York where his primary focus was undertaking audits in the financial services sector.

Specialist services delivered by a market leading team

Liz and Cian’s appointments reflect our commitment to delivering market leading services and solutions through a combination of our specialist expertise, robust methodologies, innovative use of technology and global connectivity.

If you have any queries or if we can assist you in any way, please do not hesitate to contact Liz or Cian.

Contact Liz Cahill

Contact Cian Collins

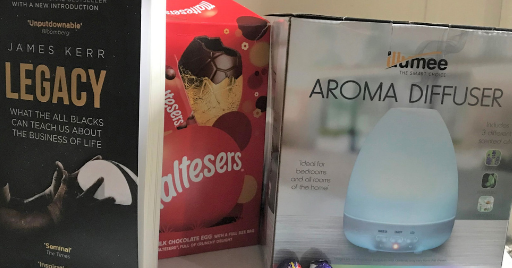

Latest News →EisnerAmper Ireland Easter Gift Boxes

EisnerAmper Ireland is delighted to have delivered Easter gift boxes to every member of our team this week.

The gift boxes are a gesture of thanks to all of our staff for their efforts working together as part of the EisnerAmper team so far this year. The gift box includes an Easter egg with some mini eggs, and the book ‘Legacy’ by James Kerr which examines the values, principles, rituals and beliefs that propelled the All Blacks rugby team to extraordinary heights. It also examines how we can adapt and apply these to our own lives, businesses and teams. Also enclosed in the gift box was an aroma oil diffuser. Aroma diffusers are a great way to elevate the mood and to promote peace of body and mind – a great addition to our home offices.

EisnerAmper Ireland would like to wish all our clients and friends of the Firm a very happy and healthy Easter.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper hosts self-awareness wellbeing workshop with The Wellness Clinic

On Friday 26 March, EisnerAmper Ireland’s CSR Committee were delighted to host our third online wellbeing workshop with Niamh O’Connell from The Wellness Clinic on Zoom, focusing on self-awareness for all our staff members.

Our Firm is focused on providing a positive, healthy and safe working environment, as well as boosting the sense of wellbeing and productivity among our employees. The Firm’s wellbeing initiatives endeavour to foster a culture where we can focus on optimising individual and team performance while offering the tools, resources and guidance to support our employees journey.

This ‘Self-Awareness’ workshop discussed overcoming obstacles in life, keeping up motivation during tough times and building confidence within ourselves. The session also focused on healthy habits we already have and broke down staff members’ long-term goals into actionable daily steps. Staff members were asked to complete a short worksheet that allowed individuals to assess their 12 week, 12 month and 5 year plans and how they could achieve these goals, while receiving lots of practical tips. Following Niamh’s presentation there was time for an Q&A session to allow staff members to ask any questions they had regarding any of the topics.

To learn more about The Wellness Clinic, click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →David Carroll Presents at Irish Debt Securities Association’s (IDSA) 2020 Financial Reporting & Audit Cycle Webinar

David Carroll, Director of EisnerAmper Ireland’s Governance, Risk & Compliance Group presented at the Irish Debt Securities Association’s (IDSA) 2020 Financial Reporting & Audit Cycle Webinar.

David discussed and led a workshop on Financial Reporting issues including:

- The impact of Covid-19; and

- Going Concern (ISA 570).

There were over 75 attendees at the webinar, including Irish Corporate Service Providers and Directors of Special Purpose Vehicles operating in Ireland.

How EisnerAmper Ireland Can Help

EisnerAmper Ireland is a Firm of specialist accountants, tax advisors and risk & regulatory experts playing a key role in bringing international trade to Ireland and advising Irish corporates. If we can help you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

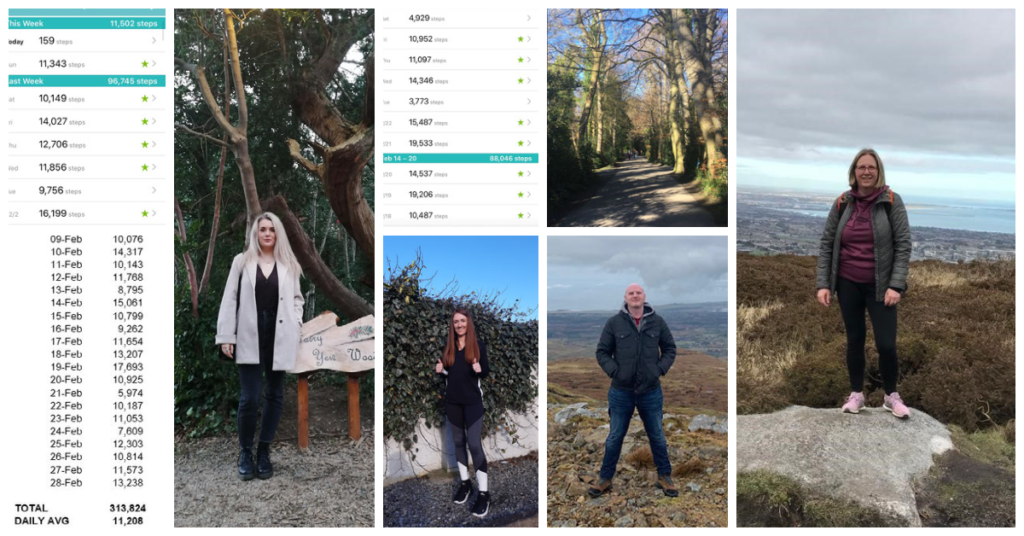

Latest News →EisnerAmper completes LauraLynn’s 280,000 steps in February Challenge

EisnerAmper Ireland was delighted to support, and partake in, LauraLynn’s 280,000 Steps in February challenge.

The charity initiative ran from the 1st to the 28th of February and members of EisnerAmper’s team were set the task of completing 280,000 steps over the 28 days while raising funds for LauraLynn through their individual JustGiving pages. We’re delighted that so many of our team surpassed their targets, collectively reaching over 2.5 million steps and raising over €1,500.

EisnerAmper was delighted to announce that we are partnering with LauraLynn Children’s Hospice as a Corporate Partner for the second year running, helping LauraLynn to support children with life-limiting conditions and their families to live as fulfilling lives as possible.

LauraLynn Children’s Hospice fundraises and supports children and families from all 26 counties with the aim of enhancing the quality of life for families in their care – including physical comfort, health and well-being, as well as the emotional, social and spiritual aspects of care.

To learn more about LauraLynn or to make a donation, please click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

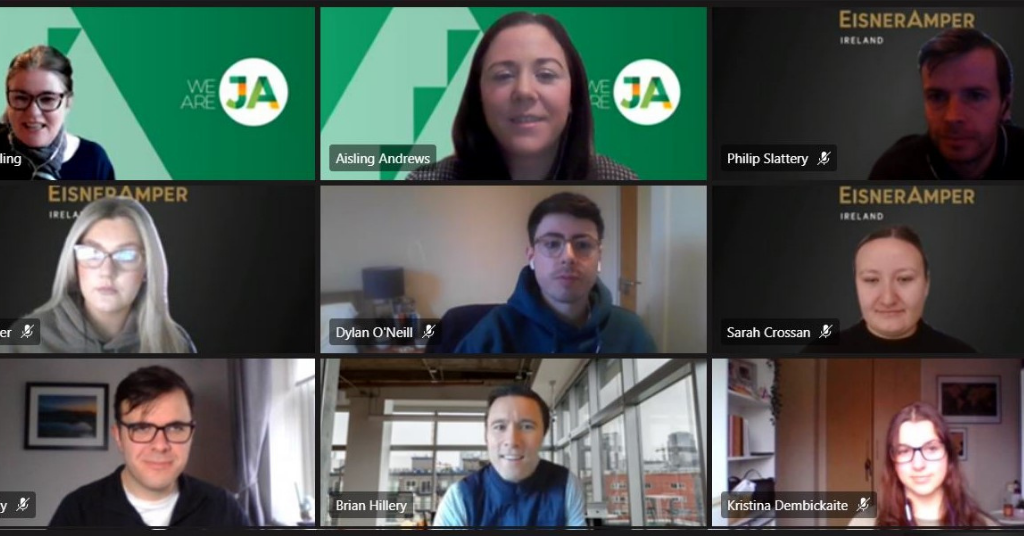

Latest News →EisnerAmper takes part in Junior Achievement Ireland 2021

As part of EisnerAmper Ireland’s Corporate Social Responsibility (CSR) programme, the Firm annually takes part in Junior Achievement Ireland (JAI), with both trainees and senior staff members assisting young people to develop the skills they need to succeed in a changing world.

This morning Aileen Dowling and Aisling Andrews from JAI gave an insightful presentation virtually on JAI’s various programmes and their virtual adaptation for this year to members of our team looking to take part in the upcoming term of virtual teaching. EisnerAmper Ireland is delighted to be continuing our longstanding support of JAI.

Junior Achievement Ireland (“Junior Achievement”) is part of a worldwide organisation reaching out to over 12 million young people each year. Junior Achievement aims to inspire and motivate young people to realise their potential by valuing education and understanding how to succeed in the world of work. This programme is operated in both primary and secondary schools and fosters a spirit of enterprise within participating schools.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →EisnerAmper supports Insurance Ireland first INED Forum of 2021

EisnerAmper Ireland, in conjunction with Insurance Ireland, was delighted to host the first INED Forum of 2021 this morning.

The webinar focused on the Central Bank of Ireland’s priorities for 2021 and the impact of Covid-19 on business operations. Frank Keane, Partner and Head of Client Internationalisation at EisnerAmper Ireland, moderated the event. We would like to thank Jacqueline Thornton, Manager of EU and Domestic & Regulatory Affairs and Company Secretary at Insurance Ireland for setting the scene, and our panellists for their insightful contributions:

- Tim O’Hanrahan – Head of Insurance Supervision Division, Central Bank of Ireland; discussed the role of an Independent Non-Executive Director during a global pandemic; 2021 priorities of the Insurance Supervision Directorate; and climate change & sustainability; and

- Caitriona Somers – Independent Non-Executive Director; discussed her thoughts and experiences of Covid-19 in relation to employee wellbeing, business operations, remote working, learning & development and succession planning.

Many thanks also to the participants who joined today’s webinar and who contributed to our very interesting Q&A session.

We deliver specialist Insurance Regulatory Compliance Services to help you meet your regulatory compliance and corporate governance requirements.

At EisnerAmper, we design and deliver specialist Services and Solutions for Business in the areas of Governance, Risk and Compliance. In this regard, if we can assist you or your business in any way, please do get in touch – we’d be delighted to help.

Contact Us

Latest News →EisnerAmper joins LauraLynn for 280,000 steps in February

EisnerAmper Ireland is delighted to announce that we are partnering with LauraLynn Children’s Hospice as a Corporate Partner for the second year running, helping them to support children with life-limiting conditions and their families to live as fulfilling lives as possible.

EisnerAmper first partnered with LauraLynn Children’s Hospice in 2020, helping them to fundraise and support children and families from all 26 counties with the aim of enhancing the quality of life for families in their care – including physical comfort, health and well-being, as well as the emotional, social and spiritual aspects of care.

The first fundraising activity of the year that EisnerAmper is participating in is LauraLynn’s 280,000 steps in February. The charity initiative is running from the 1st to the 28th February and our staff members are being set the task of completing 280,000 steps over the 28 days and raising money for the charity through their individual JustGiving pages.

To learn more about LauraLynn or to make a donation, please click here.

At EisnerAmper Ireland, we care about business and we care about the people we work with in business.

Corporate Social Responsibility (CSR) is integral to how we do business and manage interactions, not just with our employees and clients but also our wider community and society as a whole. As a professional services firm, demonstrating ethical high performance in all aspects of our work and how we run our Firm is fundamental to our success. Learn more about our CSR policy here and our CSR initiatives here.

Contact Us

Latest News →- ←« Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 36

- →Next Page »